For years, Owner-Controlled Insurance Programs (OCIPs) were only found on large, single-site projects. Every day, more contractors are being required to work under these types of arrangements, either on smaller projects or “rolling” OCIPs that cover multiple projects. This requires contractors to identify and deal with the variety of complex issues that these programs raise.

For years, Owner-Controlled Insurance Programs (OCIPs) were only found on large, single-site projects. Every day, more contractors are being required to work under these types of arrangements, either on smaller projects or “rolling” OCIPs that cover multiple projects. This requires contractors to identify and deal with the variety of complex issues that these programs raise.

Don’t go it alone. Our Construction Insurance professionals stand ready to help. If you’d like to do some research on your own, the Insurance Risk Management Institute (IRMI) provides a wealth of solid safety guidelines that are updated frequently. Originally created as a resource for contractor risk management information, IRMI publishes one of the best and most extensive libraries of insurance expertise in the nation and is widely used by insurance agents and risk managers in all types of businesses.

“A Contractor’s Guide to OCIPs,” available on the Construction Business Owner Web site, offers valuable guidelines on the benefits and risks of these programs, together with tips on making the most from them, and dealing with such issues as loss costs, separating Construction Insurance costs from bids, and estimating labor expenses.

Check out the guide. Then give us a call on how to apply its principles to your business. When it comes to your protection, don’t let “owner controlled” mean “out of control.

Read more

In a recent HR webinar, I asked three highly revealing polling questions. Here they are:

- What have you done to show your value?

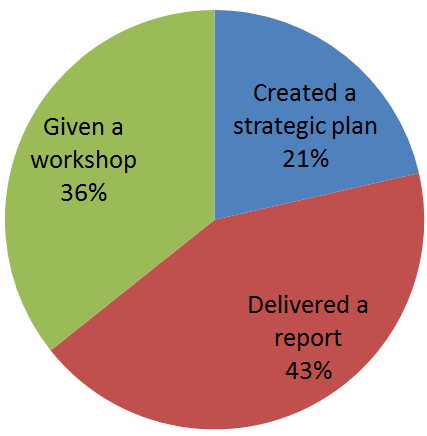

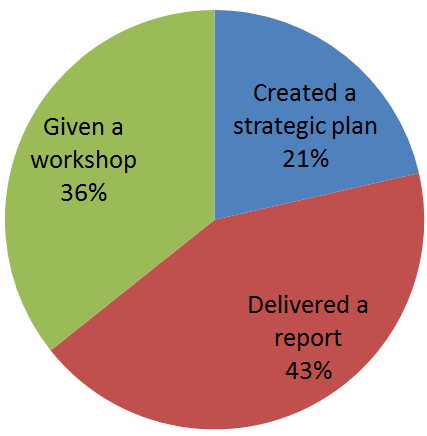

Nobody knows that you’re doing a great job unless you tell them. It’s not that they don’t care about you; it’s just that they’re running 75mph and barely have time to pay attention to anything but their own work. What effort have you made to get noticed by delivering a report or giving a workshop? Unfortunately, only 21% of respondents said that they created a strategic plan. As Mary Kay once stated, “most people spend more time planning their vacations better than their career.” Or, as I might add, their HR department.

Nobody knows that you’re doing a great job unless you tell them. It’s not that they don’t care about you; it’s just that they’re running 75mph and barely have time to pay attention to anything but their own work. What effort have you made to get noticed by delivering a report or giving a workshop? Unfortunately, only 21% of respondents said that they created a strategic plan. As Mary Kay once stated, “most people spend more time planning their vacations better than their career.” Or, as I might add, their HR department.

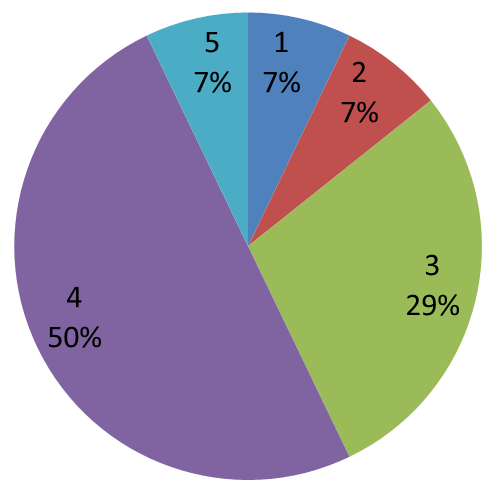

- How excited are you about the HR opportunity on a scale from 1-5 (5 being very excited)?

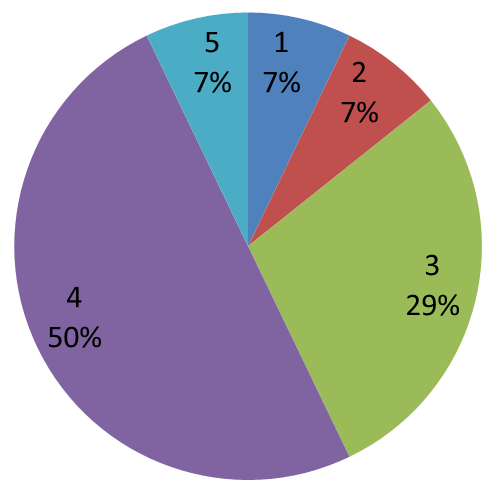

Half of the respondents described themselves as fairly “excited.” Unfortunately, some 43% were just “ok or worse” with HR. Most organizations find the whole idea of HR boring. My guess is that is not the case at the 7% of companies where people said they were very excited about HR! I believe that if 7% can be excited, so can the 93%. It’s simply a choice. What have you done in HR lately that goes beyond administrative or compliance requirements? What have you done to help improve the quality of the workplace (getting rid of poor employees and replacing them with great ones is a start), increasing performance management (having a performance management system that actually works), boosting retention, and giving greater love to that 20% of your workforce that produces 80% of results? What are you helping your company do to become more creative, innovative, and interesting?

Half of the respondents described themselves as fairly “excited.” Unfortunately, some 43% were just “ok or worse” with HR. Most organizations find the whole idea of HR boring. My guess is that is not the case at the 7% of companies where people said they were very excited about HR! I believe that if 7% can be excited, so can the 93%. It’s simply a choice. What have you done in HR lately that goes beyond administrative or compliance requirements? What have you done to help improve the quality of the workplace (getting rid of poor employees and replacing them with great ones is a start), increasing performance management (having a performance management system that actually works), boosting retention, and giving greater love to that 20% of your workforce that produces 80% of results? What are you helping your company do to become more creative, innovative, and interesting?

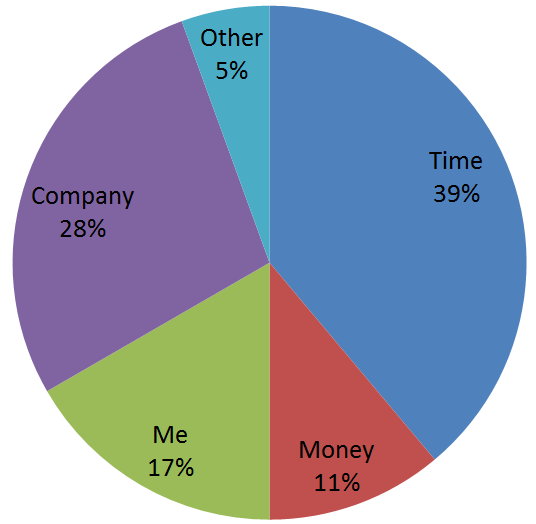

- What’s stopping you?

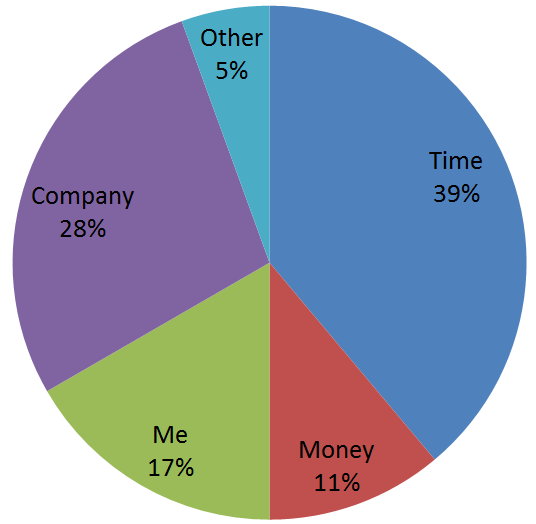

I often ask this question in workshops and in webinars. Time is always the most common response (one of those buts again), followed by the company or management. A survey of HR That Works members found that 84% of respondents said they would make better use of the service if they had more time.

I often ask this question in workshops and in webinars. Time is always the most common response (one of those buts again), followed by the company or management. A survey of HR That Works members found that 84% of respondents said they would make better use of the service if they had more time.

Time management is a major issue!

Go to the time management training on HR That Works. Watch the two videos and then start putting them into practice. I would recommend that you start by tracking where your time is going and then eliminate five hours of the uncool, un-valuable work you do every week.

Read more

The spread of social media has revolutionized not only the way we connect with friends and family, but also how we conduct business. However, this asset can quickly turn into a liability if misused – for example, in recruiting your company’s most valuable asset – its employees.

The spread of social media has revolutionized not only the way we connect with friends and family, but also how we conduct business. However, this asset can quickly turn into a liability if misused – for example, in recruiting your company’s most valuable asset – its employees.

Many employers begin the hiring process by using social-media outlets to screen applicants. LinkedIn and Facebook can provide a wealth of information about applicants’ education, their friends, and their personal behavior. Some companies reject candidates based on the content of their social-media pages. This might include anything from inappropriate photos or comments, discriminatory or slanderous statements, and references to alcohol and substance abuse, to sharing confidential information about their previous employers(s), displaying poor communication skills, or exaggerating their qualifications.

Although all of these indicators raise red flags, you could be risking a costly and annoying discrimination lawsuit if you access social-media sites which contain protected class information that’s not privileged in the normal hiring process.

To minimize this risk, it makes sense to:

- When hiring, use outside third parties such as background-verification companies and/or recruiters who document content from social-media sites in selecting candidates

- Develop and enforce a comprehensive social-media usage policy.

- Purchase an Employment Practices Liability Insurance (EPLI) policy

For more information, please feel free to get in touch with our agency

Read more

The growth rate of the rental equipment industry in the U.S. is skyrocketing by 24% a year, as more and more companies use the tax and other financial advantages of renting over purchasing. Renting also allows businesses to get the exact machine they need when they need it at a low cost, rather than spending a lot more to buy a device that would spend most of the time gathering dust.

The growth rate of the rental equipment industry in the U.S. is skyrocketing by 24% a year, as more and more companies use the tax and other financial advantages of renting over purchasing. Renting also allows businesses to get the exact machine they need when they need it at a low cost, rather than spending a lot more to buy a device that would spend most of the time gathering dust.

On the downside, if using a piece of equipment that you have rented causes damage or results in legal liability, you could be out thousands of dollars – unless you carry Rental Equipment insurance.

This policy often costs less than similar coverage offered under your Business Owners Policy or standard Commercial Property insurance. Rental Equipment insurance gives you what you need, when you need it: you can match the length of coverage to the term of the rental, rather than that of your Property policy, allowing you to save money. In most cases, it also offers lower (or zero deductibles) than standard policies.

The policy includes both Property coverage that protects the equipment from damage and Liability insurance to protect the renter from legal claims based on the use of the equipment. It also streamlines the process of providing the Certificate of Insurance that rental companies usually require before releasing their machines.

To learn more about how Rental Equipment coverage can help you protect your business – and save money – just get in touch with the insurance professionals at our agency.

Read more

The widespread use of smartphones and tablets in the workplace is exposing more and more businesses to liability for sensitive data being compromised if these devices are lost, stolen, or hacked. How can your company protect itself against this threat – and how much authority do you have over an employee’s personal device if it’s also used for work-related activities?

The widespread use of smartphones and tablets in the workplace is exposing more and more businesses to liability for sensitive data being compromised if these devices are lost, stolen, or hacked. How can your company protect itself against this threat – and how much authority do you have over an employee’s personal device if it’s also used for work-related activities?

What’s more, because these gizmos are small and portable, it’s easy to misplace them. (The federal Transportation Safety Administration recently leased a warehouse just to store those misplaced or left behind at airports.)

Another emerging risk linked to these devices is a “bring your own” policy that many companies have adopted as a way to save costs by having employees spend their own money on smartphones and tablets that are constantly evolving and updated. This approach raises questions about separating company data from personal information on the device. For example, when an employee leaves, does a business have the authority to wipe the information from his or her smartphone? According to some authorities, if an employee connects a personal device to a company network, the company has inherited responsibility for the data stored on it.

To deal with this risk, you need to provide every employee who uses these devices with training, updated annually, on how to respond in case of loss or theft. To minimize potential liability for lawsuits by customers and clients, make sure that the individual responsible for the mishap informs management immediately. The compromised information might include everything from sensitive data (financial or medical) contacts, photos, call history, personal notes – you name it.

You can also use insurance to protect yourself against losses from data breaches. A policy will provide Liability coverage that deals with legal costs and third-party expertise (such as forensics firms to analyze a breach and call centers to provide information and public relations. Coverage might also include services such as access to tools to estimate costs, a checklist for your planned response to a data breach, and access to experts who can answer questions and review your company’s policies and procedures.

For more information, feel free to give us a call.

Read more

A pipe bursts and water ruins a corner of your Brazilian cherry wood floor. A windstorm tears off half of the vinyl shingles on one side of the house. A fire burns a couple of kitchen cupboards. Although your Homeowners policy will cover such partial losses, the extent to which the insurance company must go to make everything look just the way you’d like can be tricky.

Let’s say that the new siding contrasts with the older, weathered shingles or that you can’t find replacement kitchen cupboards that precisely match the originally.

Your claim should put you back to pre-loss condition so the new part shouldn’t stick out like a sore thumb. For example, this might mean replacing the entire floor of a room even if only a portion needs repair, or repainting all four walls after damage to only one.

In some states, if replaced items don’t match in quality, color or size, the insurance company must make “reasonable repairs or replacement of items in adjoining areas.” Although other states don’t have laws on matching, some Homeowners insurers have added similar “non-matching language” to their policies.

Besides varying by state, insurer, and policy, the issue of patching versus full replacement can depends on insurance company adjusters.

If you can’t get make any headway with the adjuster on the repairs you want, consider going over his or her head to a supervisor, or file a complaint with the state insurance department. Another option is to hire a public insurance adjuster to work on your behalf through the claims process. These professionals usually charge about 10% of the final settlement.

Read more

For years, Owner-Controlled Insurance Programs (OCIPs) were only found on large, single-site projects. Every day, more contractors are being required to work under these types of arrangements, either on smaller projects or “rolling” OCIPs that cover multiple projects. This requires contractors to identify and deal with the variety of complex issues that these programs raise.

For years, Owner-Controlled Insurance Programs (OCIPs) were only found on large, single-site projects. Every day, more contractors are being required to work under these types of arrangements, either on smaller projects or “rolling” OCIPs that cover multiple projects. This requires contractors to identify and deal with the variety of complex issues that these programs raise.

Nobody knows that you’re doing a great job unless you tell them. It’s not that they don’t care about you; it’s just that they’re running 75mph and barely have time to pay attention to anything but their own work. What effort have you made to get noticed by delivering a report or giving a workshop? Unfortunately, only 21% of respondents said that they created a strategic plan. As Mary Kay once stated, “most people spend more time planning their vacations better than their career.” Or, as I might add, their HR department.

Nobody knows that you’re doing a great job unless you tell them. It’s not that they don’t care about you; it’s just that they’re running 75mph and barely have time to pay attention to anything but their own work. What effort have you made to get noticed by delivering a report or giving a workshop? Unfortunately, only 21% of respondents said that they created a strategic plan. As Mary Kay once stated, “most people spend more time planning their vacations better than their career.” Or, as I might add, their HR department. Half of the respondents described themselves as fairly “excited.” Unfortunately, some 43% were just “ok or worse” with HR. Most organizations find the whole idea of HR boring. My guess is that is not the case at the 7% of companies where people said they were very excited about HR! I believe that if 7% can be excited, so can the 93%. It’s simply a choice. What have you done in HR lately that goes beyond administrative or compliance requirements? What have you done to help improve the quality of the workplace (getting rid of poor employees and replacing them with great ones is a start), increasing performance management (having a performance management system that actually works), boosting retention, and giving greater love to that 20% of your workforce that produces 80% of results? What are you helping your company do to become more creative, innovative, and interesting?

Half of the respondents described themselves as fairly “excited.” Unfortunately, some 43% were just “ok or worse” with HR. Most organizations find the whole idea of HR boring. My guess is that is not the case at the 7% of companies where people said they were very excited about HR! I believe that if 7% can be excited, so can the 93%. It’s simply a choice. What have you done in HR lately that goes beyond administrative or compliance requirements? What have you done to help improve the quality of the workplace (getting rid of poor employees and replacing them with great ones is a start), increasing performance management (having a performance management system that actually works), boosting retention, and giving greater love to that 20% of your workforce that produces 80% of results? What are you helping your company do to become more creative, innovative, and interesting? I often ask this question in workshops and in webinars. Time is always the most common response (one of those buts again), followed by the company or management. A survey of HR That Works members found that 84% of respondents said they would make better use of the service if they had more time.

I often ask this question in workshops and in webinars. Time is always the most common response (one of those buts again), followed by the company or management. A survey of HR That Works members found that 84% of respondents said they would make better use of the service if they had more time. The spread of social media has revolutionized not only the way we connect with friends and family, but also how we conduct business. However, this asset can quickly turn into a liability if misused – for example, in recruiting your company’s most valuable asset – its employees.

The spread of social media has revolutionized not only the way we connect with friends and family, but also how we conduct business. However, this asset can quickly turn into a liability if misused – for example, in recruiting your company’s most valuable asset – its employees. The growth rate of the rental equipment industry in the U.S. is skyrocketing by 24% a year, as more and more companies use the tax and other financial advantages of renting over purchasing. Renting also allows businesses to get the exact machine they need when they need it at a low cost, rather than spending a lot more to buy a device that would spend most of the time gathering dust.

The growth rate of the rental equipment industry in the U.S. is skyrocketing by 24% a year, as more and more companies use the tax and other financial advantages of renting over purchasing. Renting also allows businesses to get the exact machine they need when they need it at a low cost, rather than spending a lot more to buy a device that would spend most of the time gathering dust. The widespread use of smartphones and tablets in the workplace is exposing more and more businesses to liability for sensitive data being compromised if these devices are lost, stolen, or hacked. How can your company protect itself against this threat – and how much authority do you have over an employee’s personal device if it’s also used for work-related activities?

The widespread use of smartphones and tablets in the workplace is exposing more and more businesses to liability for sensitive data being compromised if these devices are lost, stolen, or hacked. How can your company protect itself against this threat – and how much authority do you have over an employee’s personal device if it’s also used for work-related activities?