With more people working remotely and spending the entire day looking at computers and phones, they are at risk for eyestrain.

We recommend that they follow these basic precautions.

- Look away from the monitor for 30 seconds, every 15 or 20 minutes. Look at or scan things at least 20 feet away to allow your eyes to focus in a rest position.

- Reposition the monitor 20” to 26” from your eyes (roughly the distance from your eyes to the end of your index finger with arm outstretched). Otherwise, you’ll be forced to sit or lean too close to the screen, or sit too far away. If your eyeglass prescription doesn’t allow clear vision at the 20” to 26” range, get it adjusted.

- Reset monitor height so that the top edge is even with your view when looking straight ahead. Then tilt the screen upward so that you’re not looking at the image at an angle. The optimal screen position is 10 to 20 degrees below eye level.

- Reset the monitor screen resolution, the Internet browser text size, and the zoom and font default in the operating system and in software applications so that text is easy to read. Start with a screen resolution of 800×600 for older CRT monitors and 1024×768 or higher for LCD (flat screen) monitors. Set the monitor refresh rate at or above 75 hertz (Hz) on older CRT models. Refresh rate is irrelevant for LCD monitors and is factory set, usually 60 Hz.

- Blink often (put a sticky note on your monitor!). The average blink rate is 22 times per minute. The rate goes down to seven per minute when looking at a monitor – which causes the eye lens to dry out. If you can’t get into the habit of blinking more often, use an eye moistener (saline solution).

- Relax your eye muscles. Put the palm of your hands over your eyes for a minute or so, once every half hour. This warms the muscles around the eyes, relaxing them.

- Minimize glare. Make sure the background light level around the monitor is about the same as the screen light level. Minimize direct sunlight or bright lights in front of the monitor or directly behind it.

- Adjust the contrast and brightness to levels you use when reading a book comfortably. A bright screen causes eyestrain.

- Use a paper holder to hold documents. Put the document at the same level as the monitor, or attach it to the monitor. This prevents repetitive neck and eye movement from paper to screen.

Read more

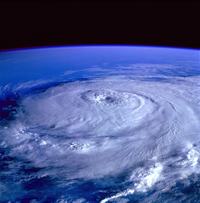

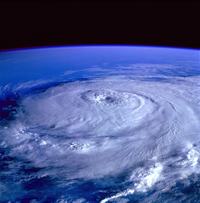

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

Acts of God will exempt a party from strict liability and from negligence in common law. Many building contracts have a provision allowing for acts of God to excuse unexpected delays in a project’s completion. However, damages and delays owing to a natural disaster may be disputed as acts of God in some circumstance.

The key word is “unforeseeable.” If someone falls off of a scaffolding and spends the next four weeks in a cast because of an earthquake, then that will usually be chalked up to an act of God. If they saw a storm coming in, decided to keep working, and then got struck by lightning, then the “act of God” claim may be contested.

“Act of God” is sort of a liability free-pass card, exempting you from responsibility for things that you couldn’t possibly have predicted. There are a few steps that you can take to ensure that there is no gray area, no room for doubt when you need to lean on this legal term:

- Keep tabs on the weather. Don’t assume, for instance, that a storm “isn’t going to be as bad as they say.” It might not be so bad, but do you want to bet your career on it?

- Keep all of your safety equipment in tip top shape. You don’t want to give people any wiggle room to say that that safety harness would have snapped eventually with or without the earthquake.

- This goes for your vehicles, as well. It’s hard to claim a small flood as an “act of God” when your truck was the only one slipping and sliding across the road.

An act of God can be a godsend when it comes to liability, but things have to line up correctly.

Read more

Summer time fun for you might include hauling a trailer. It secures your ATV, boat, a second car, camper, horses or camping gear. Before you hit the road, make sure your trailer is properly insured.

Summer time fun for you might include hauling a trailer. It secures your ATV, boat, a second car, camper, horses or camping gear. Before you hit the road, make sure your trailer is properly insured.

Why do you Need Trailer Insurance?

Many states accept your auto insurance coverage when you haul a trailer behind your insured vehicle. Your homeowners or renters insurance policy may cover the items you haul. However, this coverage is typically only for liability. Plus, you face several risks when you haul your trailer on the road.

- If you’re not used to hauling a trailer, your risk of causing an accident increases.

- You may turn too sharply and damage someone’s property.

- You could hit a slippery stretch of highway that causes your trailer to slide into another vehicle and damage it or push it off the road.

- While unloading or loading your trailer, you could damage it or the item you’re hauling.

These and other accidents are possible. Trailer insurance adds valuable protection that gives you peace of mind as you travel.

What Type of Coverage is Available?

The type and amount of trailer insurance you need depends on your trailer’s type and size and on the value of the items you will haul. Typical trailer insurance provides several valuable coverages.

- Liability – Cover the costs associated with bodily injuries or property damages your trailer causes to other people or their property and belongings.

- Comprehensive – Repair your trailer if it is damaged from theft, vandalism, fire or weather.

- Collision – Repair your trailer if it is damaged during a traffic collision.

- Contents Coverage – Pay to replace damaged items that are stored on or hauled in your trailer.

How do you Purchase Trailer Insurance?

Talk to your auto insurance agent about trailer insurance. He or she will review your auto insurance policy’s current types of coverage and limits to ensure it’s adequate for your trailer. Your agent will also review your homeowners or renters insurance policy and ensure it covers the items you are hauling.

If your current policies are not adequate to cover your trailer and its contents, increase your coverage types or limits or purchase a separate policy. You may need to shop around for trailer insurance if your current agent does not carry it.

With trailer insurance, you can travel this summer with confidence. If your trailer causes property damage or bodily injury or if the items you haul are damaged, you can pay for the liability or repairs. Talk to your agent before your next trip to make sure you’re properly covered.

Read more

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend. Summer time fun for you might include hauling a trailer. It secures your ATV, boat, a second car, camper, horses or camping gear. Before you hit the road, make sure your trailer is properly insured.

Summer time fun for you might include hauling a trailer. It secures your ATV, boat, a second car, camper, horses or camping gear. Before you hit the road, make sure your trailer is properly insured.