National Cybersecurity Awareness Month (NCSAM) occurs annually in October. Started in 2003 by the U.S. Department of Homeland Security and private sector sponsors and nonprofit collaborators that form the National Cyber Security Alliance, this annual event promotes cybersecurity and recommends resources for online safety.  You and your company can make several preparations this month as you look forward to celebrating Cybersecurity Awareness Month with your employees, customers and community.

You and your company can make several preparations this month as you look forward to celebrating Cybersecurity Awareness Month with your employees, customers and community.

Host an Educational Event

Begin planning an open house, expo, lecture, or other educational event that focuses on cybersecurity. Depending on your company, you may decide to focus your educational efforts on information that will benefit senior citizens, college students or families. For example, your IT specialist could present advice that helps consumers avoid cybercrime, or you could show customers how to implement security protocols on their electronic devices. Get creative as you prepare to raise cybersecurity awareness during an educational event.

Train Employees

Cybersecurity training should occur year-round, but your employees may be especially receptive to security tips during a month that’s focused on raising awareness. Take advantage of this annual opportunity to discuss topics like choosing secure passwords, securing electronic devices used for work and managing email safety. Or choose a different topic based on your unique needs.

Focus on Different Weekly Topics

This year, NCSAM includes four weekly topics. In summary, those topics include:

- Online safety at home.

- Training for a cybersecurity career.

- Ensuring online safety at work.

- Safeguarding critical infrastructure throughout the nation.

Your company can prepare to discuss these weekly topics during your events, through customer newsletters and on social media.

Utilize Your Social Media Influence

If your company has a large social media following, you have a powerful platform to raise awareness for cybersecurity. You can write blog posts that outline the importance of cybersecurity, share information about how to join the cybersecurity workforce or detail the ways your business protects data. Also, prepare info-graphs and other visual aids that discuss online safety tips.

Partner with Other Companies

Like NCSAM was started through a collaboration, your company can partner with other businesses as you increase cybersecurity awareness. Share the latest cybersecurity information, create resources that educate the public about cybersecurity or host an online safety seminar together.

Check your Cybersecurity Insurance Coverage

Cybersecurity insurance protects your business in many circumstances. Review your needs with your insurance agent as you ensure you have the correct amount of cybersecurity insurance for your company.

As your business prepares to celebrate National Cybersecurity Awareness Month in October, consider taking these steps now. They give you the tools you need to raise cybersecurity awareness among your employees, customers and community.

Read more

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

Covered Water Sport Businesses

Your water sports business could encompass dozens of activities in, on or near water. Whether you offer one or several sports, you will need Workers’ Compensation for your business. Example of water sports offerings include:

- Fishing

- Boating, Sailing, Yachting

- Kayaking, Tubing, Canoeing

- White Water Rafting

- Jet or Water Skiing

- Parasailing

- Kneeboarding, Skimboarding

- Kitesurfing, Kiteboarding

- Hoverboarding, Flyboarding, Wakeboarding

- Paddleboarding, Paddle Surfing

- Snorkeling or Scuba Diving

- Swimming and Diving

- Polo

- Surfing

What is Workers’ Compensation?

Many states require business owners to purchase Workers’ Compensation for employees, including seasonal and temporary workers. It pays certain expenses employees incur if they are injured or suffer an illness while performing work-related tasks.

Workers’ Compensation benefits can pay for:

- Medical care

- Lost wages

- Death benefits

- Vocational rehabilitation

Every Workers’ Compensation insurance policy has two parts.

Part One or Coverage A addresses your statutory liability, meaning the coverage your state requires you to carry. It includes no coverage limits and will pay all claims regardless of any benefit changes your state makes.

Part Two addresses employer liability for any employees that are exempt from Worker’s Compensation coverage. These employees could include independent contractors like boat owners or dive instructors who do not purchase their own Worker’s Compensation policy. Part Two can also cover legal expenses from third-party lawsuits.

Why you Need Workers’ Compensation for Your Water Sport Business

Whether your business operates year-round or seasonally, you value your employees and want to protect them from injuries or illnesses. However, accidents happen. You will want to provide financial resources that help your employees navigate their recovery and return to full health and work as quickly as possible.

Adequate Workers’ Compensation protects your business, too. It can protect your assets if you are sued by an employee, and it can pay legal expenses related to any lawsuits. Workers’ Compensation coverage also protects you from fines levied by your state if you don’t purchase adequate coverage.

Contact Your Insurance Agent

For more information on Workers’ Compensation for your specific water sport businesses, contact your insurance agent. He or she will assist you in understanding and complying with your state’s Workers’ Compensation laws. Your agent will also help you purchase the policy that’s right for your business and needs.

With the right Workers’ Compensation policy, you receive peace of mind. It protects your employees and your assets as you help your customers have fun while playing on the water.

Read more

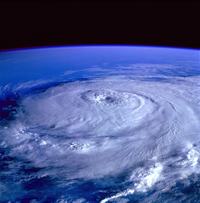

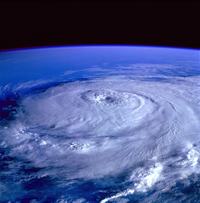

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

Acts of God will exempt a party from strict liability and from negligence in common law. Many building contracts have a provision allowing for acts of God to excuse unexpected delays in a project’s completion. However, damages and delays owing to a natural disaster may be disputed as acts of God in some circumstance.

The key word is “unforeseeable.” If someone falls off of a scaffolding and spends the next four weeks in a cast because of an earthquake, then that will usually be chalked up to an act of God. If they saw a storm coming in, decided to keep working, and then got struck by lightning, then the “act of God” claim may be contested.

“Act of God” is sort of a liability free-pass card, exempting you from responsibility for things that you couldn’t possibly have predicted. There are a few steps that you can take to ensure that there is no gray area, no room for doubt when you need to lean on this legal term:

- Keep tabs on the weather. Don’t assume, for instance, that a storm “isn’t going to be as bad as they say.” It might not be so bad, but do you want to bet your career on it?

- Keep all of your safety equipment in tip top shape. You don’t want to give people any wiggle room to say that that safety harness would have snapped eventually with or without the earthquake.

- This goes for your vehicles, as well. It’s hard to claim a small flood as an “act of God” when your truck was the only one slipping and sliding across the road.

An act of God can be a godsend when it comes to liability, but things have to line up correctly.

Read more

You and  your company can make several preparations regularly to help prevent a cyber attack.

your company can make several preparations regularly to help prevent a cyber attack.

Host an Educational Event

Begin planning an open house, expo, lecture, or other educational event that focuses on cybersecurity. Depending on your company, you may decide to focus your educational efforts on information that will benefit senior citizens, college students or families. For example, your IT specialist could present advice that helps consumers avoid cybercrime, or you could show customers how to implement security protocols on their electronic devices. Get creative as you prepare to raise cybersecurity awareness during an educational event.

Train Employees

Cybersecurity training should occur year-round, but your employees may be especially receptive to security tips during a month that’s focused on raising awareness. Take advantage of this annual opportunity to discuss topics like choosing secure passwords, securing electronic devices used for work and managing email safety. Or choose a different topic based on your unique needs.

Focus on Different Weekly Topics

Some topic ideas include:

- Online safety at home.

- Training for a cybersecurity career.

- Ensuring online safety at work.

- Safeguarding critical infrastructure throughout the nation.

Your company can prepare to discuss these weekly topics during your events, through customer newsletters and on social media.

Utilize Your Social Media Influence

If your company has a large social media following, you have a powerful platform to raise awareness for cybersecurity. You can write blog posts that outline the importance of cybersecurity, share information about how to join the cybersecurity workforce or detail the ways your business protects data. Also, prepare infographs and other visual aids that discuss online safety tips.

Partner with Other Companies

Your company can partner with other businesses as you increase cybersecurity awareness. Share the latest cybersecurity information, create resources that educate the public about cybersecurity or host an online safety seminar together.

Check your Cybersecurity Insurance Coverage

Cybersecurity insurance protects your business in many circumstances. Review your needs with your Scurich insurance agent as you ensure you have the correct amount of cybersecurity insurance for your company.

Consider taking these steps now. They give you the tools you need to raise cybersecurity awareness among your employees, customers and community.

Read more

Most business owners would agree that it’s important to maintain insurance to protect business assets. But, many business owners do not know that they will not be able to contract with other companies (landlord’s, vendors, large customers, etc.) without certain insurance coverage.

Most business owners would agree that it’s important to maintain insurance to protect business assets. But, many business owners do not know that they will not be able to contract with other companies (landlord’s, vendors, large customers, etc.) without certain insurance coverage.

When they think about insurance, business owners generally consider protection against hazards such as fire, flood or theft at their company sites. This is obviously an important protection to have. However, there are other types of hazards that may not be quite as high on the list, but protection could be every bit as important to offset significant financial losses. Here are five examples that underscore the need for comprehensive business insurance protection:

Company vehicle contents

If you operate a business with employees on the road making service calls to customers, chances are there is valuable equipment contained in the company vehicles. But a typical auto insurance policy would probably not cover the contents of a company vehicle if that valuable equipment is lost or stolen.

Tenant property improvement insurance

Do you rent space to conduct your business? Have you built out the interior of your space or made improvements to accommodate your business needs? If so, you probably made a considerable investment in the improvements. But many property insurance policies don’t include the value of the improvements made by a tenant to the existing structure. If you’ve invested in improvements, it’s worth taking a look at securing coverage to protect it.

Home-based business equipment

More and more people are working at home at least part of the time, even if they maintain an office or site elsewhere. Most don’t have insurance on the business equipment they keep at home; many assume their homeowner’s insurance would cover it. However, homeowner’s insurance generally does not cover business equipment. If you have expensive business equipment at home, you may want to consider purchasing additional protection.

Business interruption insurance

Remember the series of hurricanes that hit Florida? The wild fires that damaged cities and towns in California? The flooding that disrupted life in the Midwest? In addition to the effect that disasters have on individuals, they can bring businesses to a standstill for weeks or even months. Business interruption insurance can provide a way to get back on your feet.

Key person insurance

In many companies, the knowledge and skills of a single person or a top few are absolutely essential to the enterprise’s success. Key person insurance can help a company recover if an essential employee dies or becomes disabled for a lengthy time. The coverage can provide needed funds that allow the company to continue operating during a search for a successor or until the key employee returns.

As you can see, there are many hazards businesses face that aren’t covered under a typical insurance policy. However, you can get extra protection with the types of coverage outlined here. Since you invest so much time, money and effort into your business, it pays to make sure you have the protection you need. Call us for a consultation today!

Read more

You pay premium prices for great Internet, now that you work remotely (from home). You need high speed Internet, so getting it back up to speed when it starts to slow down is a top priority. Here’s a quick troubleshooting guide to help you determine whether you can apply a quick fix, or if you might need to make a phone call:

You pay premium prices for great Internet, now that you work remotely (from home). You need high speed Internet, so getting it back up to speed when it starts to slow down is a top priority. Here’s a quick troubleshooting guide to help you determine whether you can apply a quick fix, or if you might need to make a phone call:

Boosting Your Wifi Signal

The issue might not be your Internet connection, but your Wifi signal. It doesn’t matter how fast your web connection is when you’re too far away from your Wifi router or it’s putting out a weak signal. Plug directly into your Internet with a wired connection. If it runs fine, you may simply need to buy a more powerful router, switch to wired connections, or rearrange your office space so that your router can reach everyone who needs it. Also, consider a ‘mesh’ wireless system.

Someone’s Doing Some Heavy Downloading

Let others know that business-class internet doesn’t mean “Go ahead and do all your bit torrenting at the office from now on.” Downloading twenty eight movies at once while uploading fifteen others is going to slow you down.

Do a Security Check

Your network may be infected with a worm. More so than most viruses and malware, worms can really drag your connection down to a crawl. A network scan will be able to help you root out the intruder if this is the case.

See if Someone is Stealing Your Wifi

You can check your router device list to see if someone is connecting without permission. If so, you can change the password, and/or switch your security settings to WPA2-AES.

Call Your Provider

Call your provider and ask there are any issues in your area. It may simply be a temporary issue that they are already hard at work rectifying. And if that doesn’t work…

Start Shopping Around for a New Provider

Your provider might just not be up to the task of providing you with top-notch business grade Internet. If there are competing ISP’s in your area, don’t hesitate to get some quotes and compare download speeds. Brand loyalty is all well and good, but you don’t owe it to an ISP that isn’t providing.

Read more

You and your company can make several preparations this month as you look forward to celebrating Cybersecurity Awareness Month with your employees, customers and community.

You and your company can make several preparations this month as you look forward to celebrating Cybersecurity Awareness Month with your employees, customers and community.

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets. In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend. Most business owners would agree that it’s important to maintain insurance to protect business assets. But, many business owners do not know that they will not be able to contract with other companies (landlord’s, vendors, large customers, etc.) without certain insurance coverage.

Most business owners would agree that it’s important to maintain insurance to protect business assets. But, many business owners do not know that they will not be able to contract with other companies (landlord’s, vendors, large customers, etc.) without certain insurance coverage.  You pay premium prices for great Internet, now that you work remotely (from home). You need high speed Internet, so getting it back up to speed when it starts to slow down is a top priority. Here’s a quick troubleshooting guide to help you determine whether you can apply a quick fix, or if you might need to make a phone call:

You pay premium prices for great Internet, now that you work remotely (from home). You need high speed Internet, so getting it back up to speed when it starts to slow down is a top priority. Here’s a quick troubleshooting guide to help you determine whether you can apply a quick fix, or if you might need to make a phone call: