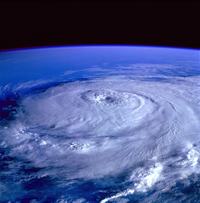

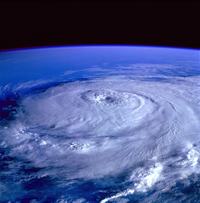

Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive.

Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive.

Survival Essentials

A warm blanket, spare set of clothes and matches could make the difference in your survival. Pack these and all other essential supplies you might need in an airtight container that’s easily accessible.

Food and Water

The Red Cross suggests families store two weeks’ worth of food and water, which means you’ll need one gallon of water per person per day and a variety of easily prepared, non-perishable foods. Don’t forget to stock baby and pet food if necessary, too.

First Aid

Minor bumps and bruises can occur as your family rushes to safety. Your first aid kit should include basic first aid supplies like bandages, antibacterial cream, burn cream and pain reliever. Pack prescription medications, hearing aid batteries and other specialized medications if needed.

Hygiene Items

Toilet paper, toothbrushes and diapers are essential. Hand sanitizer and bleach should also be included in your emergency kit.

Stay Connected

You’ll want to stay connected to the outside world and signal for help, so include a battery-powered radio, extra batteries, your cell phone and chargers in your emergency kit. A flashlight and whistle for each person is also a good idea.

Tools

Whether you have to dig out of the basement or open a soup can, tools come in handy. Stock a multipurpose tool, work gloves, scissors, shovel, screwdriver set, hammer and manual can opener in your kit.

Important Papers

In the rush of an evacuation, you may forget to grab your purse or wallet. Copy important papers like your driver’s license, birth certificate, insurance policies and medical information. Store them, extra cash and your family’s emergency contact information in a waterproof bag to keep them safe.

This home emergency kit will play a big role in keeping you safe when volatile spring weather strikes. Update your insurance policies, too, as you stay protected and prepared.

Read more

National Cybersecurity Awareness Month (NCSAM) occurs annually in October. Started in 2003 by the U.S. Department of Homeland Security and private sector sponsors and nonprofit collaborators that form the National Cyber Security Alliance, this annual event promotes cybersecurity and recommends resources for online safety.  You, your family and/or your company can make several preparations this month.

You, your family and/or your company can make several preparations this month.

Host an Educational Event

Begin planning an open house, expo, lecture, or other educational event that focuses on cybersecurity. Depending on your company, you may decide to focus your educational efforts on information that will benefit senior citizens, college students or families. For example, your IT specialist could present advice that helps consumers avoid cybercrime, or you could show customers how to implement security protocols on their electronic devices. Get creative as you prepare to raise cybersecurity awareness during an educational event.

Train Employees

Cybersecurity training should occur year-round, but your employees may be especially receptive to security tips during a month that’s focused on raising awareness. Take advantage of this annual opportunity to discuss topics like choosing secure passwords, securing electronic devices used for work and managing email safety. Or choose a different topic based on your unique needs.

Focus on Different Weekly Topics

This year, NCSAM includes four weekly topics. In summary, those topics include:

- Online safety at home.

- Training for a cybersecurity career.

- Ensuring online safety at work.

- Safeguarding critical infrastructure throughout the nation.

Your company can prepare to discuss these weekly topics during your events, through customer newsletters and on social media.

Utilize Your Social Media Influence

If your company has a large social media following, you have a powerful platform to raise awareness for cybersecurity. You can write blog posts that outline the importance of cybersecurity, share information about how to join the cybersecurity workforce or detail the ways your business protects data. Also, prepare infographs and other visual aids that discuss online safety tips.

Partner with Other Companies

Like NCSAM was started through a collaboration, your company can partner with other businesses as you increase cybersecurity awareness. Share the latest cybersecurity information, create resources that educate the public about cybersecurity or host an online safety seminar together.

Check your Cybersecurity Insurance Coverage

Cybersecurity insurance protects your business in many circumstances. Review your needs with your insurance agent as you ensure you have the correct amount of cybersecurity insurance for you and your company.

As your business prepares to celebrate National Cybersecurity Awareness Month in October, consider taking these steps now. They give you the tools you need to raise cybersecurity awareness among your employees, customers and community.

Read more

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

Covered Water Sport Businesses

Your water sports business could encompass dozens of activities in, on or near water. Whether you offer one or several sports, you will need Workers’ Compensation for your business. Example of water sports offerings include:

- Fishing

- Boating, Sailing, Yachting

- Kayaking, Tubing, Canoeing

- White Water Rafting

- Jet or Water Skiing

- Parasailing

- Kneeboarding, Skimboarding

- Kitesurfing, Kiteboarding

- Hoverboarding, Flyboarding, Wakeboarding

- Paddleboarding, Paddle Surfing

- Snorkeling or Scuba Diving

- Swimming and Diving

- Polo

- Surfing

What is Workers’ Compensation?

Many states require business owners to purchase Workers’ Compensation for employees, including seasonal and temporary workers. It pays certain expenses employees incur if they are injured or suffer an illness while performing work-related tasks.

Workers’ Compensation benefits can pay for:

- Medical care

- Lost wages

- Death benefits

- Vocational rehabilitation

Every Workers’ Compensation insurance policy has two parts.

Part One or Coverage A addresses your statutory liability, meaning the coverage your state requires you to carry. It includes no coverage limits and will pay all claims regardless of any benefit changes your state makes.

Part Two addresses employer liability for any employees that are exempt from Worker’s Compensation coverage. These employees could include independent contractors like boat owners or dive instructors who do not purchase their own Worker’s Compensation policy. Part Two can also cover legal expenses from third-party lawsuits.

Why you Need Workers’ Compensation for Your Water Sport Business

Whether your business operates year-round or seasonally, you value your employees and want to protect them from injuries or illnesses. However, accidents happen. You will want to provide financial resources that help your employees navigate their recovery and return to full health and work as quickly as possible.

Adequate Workers’ Compensation protects your business, too. It can protect your assets if you are sued by an employee, and it can pay legal expenses related to any lawsuits. Workers’ Compensation coverage also protects you from fines levied by your state if you don’t purchase adequate coverage.

Contact Your Insurance Agent

For more information on Workers’ Compensation for your specific water sport businesses, contact your insurance agent. He or she will assist you in understanding and complying with your state’s Workers’ Compensation laws. Your agent will also help you purchase the policy that’s right for your business and needs.

With the right Workers’ Compensation policy, you receive peace of mind. It protects your employees and your assets as you help your customers have fun while playing on the water.

Read more

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

Acts of God will exempt a party from strict liability and from negligence in common law. Many building contracts have a provision allowing for acts of God to excuse unexpected delays in a project’s completion. However, damages and delays owing to a natural disaster may be disputed as acts of God in some circumstance.

The key word is “unforeseeable.” If someone falls off of a scaffolding and spends the next four weeks in a cast because of an earthquake, then that will usually be chalked up to an act of God. If they saw a storm coming in, decided to keep working, and then got struck by lightning, then the “act of God” claim may be contested.

“Act of God” is sort of a liability free-pass card, exempting you from responsibility for things that you couldn’t possibly have predicted. There are a few steps that you can take to ensure that there is no gray area, no room for doubt when you need to lean on this legal term:

- Keep tabs on the weather. Don’t assume, for instance, that a storm “isn’t going to be as bad as they say.” It might not be so bad, but do you want to bet your career on it?

- Keep all of your safety equipment in tip top shape. You don’t want to give people any wiggle room to say that that safety harness would have snapped eventually with or without the earthquake.

- This goes for your vehicles, as well. It’s hard to claim a small flood as an “act of God” when your truck was the only one slipping and sliding across the road.

An act of God can be a godsend when it comes to liability, but things have to line up correctly.

Read more

You and  your company can make several preparations regularly to help prevent a cyber attack.

your company can make several preparations regularly to help prevent a cyber attack.

Host an Educational Event

Begin planning an open house, expo, lecture, or other educational event that focuses on cybersecurity. Depending on your company, you may decide to focus your educational efforts on information that will benefit senior citizens, college students or families. For example, your IT specialist could present advice that helps consumers avoid cybercrime, or you could show customers how to implement security protocols on their electronic devices. Get creative as you prepare to raise cybersecurity awareness during an educational event.

Train Employees

Cybersecurity training should occur year-round, but your employees may be especially receptive to security tips during a month that’s focused on raising awareness. Take advantage of this annual opportunity to discuss topics like choosing secure passwords, securing electronic devices used for work and managing email safety. Or choose a different topic based on your unique needs.

Focus on Different Weekly Topics

Some topic ideas include:

- Online safety at home.

- Training for a cybersecurity career.

- Ensuring online safety at work.

- Safeguarding critical infrastructure throughout the nation.

Your company can prepare to discuss these weekly topics during your events, through customer newsletters and on social media.

Utilize Your Social Media Influence

If your company has a large social media following, you have a powerful platform to raise awareness for cybersecurity. You can write blog posts that outline the importance of cybersecurity, share information about how to join the cybersecurity workforce or detail the ways your business protects data. Also, prepare infographs and other visual aids that discuss online safety tips.

Partner with Other Companies

Your company can partner with other businesses as you increase cybersecurity awareness. Share the latest cybersecurity information, create resources that educate the public about cybersecurity or host an online safety seminar together.

Check your Cybersecurity Insurance Coverage

Cybersecurity insurance protects your business in many circumstances. Review your needs with your Scurich insurance agent as you ensure you have the correct amount of cybersecurity insurance for your company.

Consider taking these steps now. They give you the tools you need to raise cybersecurity awareness among your employees, customers and community.

Read more

How many times do you walk by fire extinguishers without checking those tags or past first aid kits without peeking inside to assure the contents are complete?

Most executives do not spot check these life saving tools. That task is delegated to maintenance. But these decisions are life and death, not simply profit or loss. Show your employees you care; that you lead their safety program rather than follow pro forma insurance checklists.

Start your spring cleaning here: walk through your operation and stop occasionally to check if you can easily spot the nearest fire extinguisher. Read the label. Is it appropriate for the work area?

Stand at each fire extinguisher station and visualize successful deployment. Is it easy and natural? Can you travel unharmed to the nearest fire exit using the fire extinguisher to clear a path?

Observe any long pathways between fire extinguishers and exits. Would another canister or different fire suppression device or system help?

Take some notes as you walk through the operation. Review these observations with the person tasked to keep the equipment updated.

Repeat the above exercise with regard to first aid kits. Are they easy to spot? Easy to access one-handed? Do they have instructions for calling emergency help?

These exercises do not require a great deal of time or scheduling. Simply make a point of checking these items every quarter, something of an internal surprise inspection.

Add ten minutes every three months to your walk-through routine. It doesn’t need scheduling or ceremony. Simply observe, become conscious of the emergency response routine. Are fire exits clogged with storage or debris? Are aisles kept unobstructed?

Is a specific person charged with de-icing fire escapes? As you walk through your operations, take notes of these questions. Think through an emergency evacuation, then review the written plan for your company. Does it make common sense? Does it raise questions for your risk manager or safety specialist?

Does your at-hire training include safety orientation and procedures? How about on-going communications on safety issues? Both directions?

Corporate officers lead the safety culture. Make these inspections in view of employees. They will engage you if they have proper concerns. They are a great resource.

Read more

You, your family and/or your company can make several preparations this month.

You, your family and/or your company can make several preparations this month. With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets.

With the Olympics in it’s third week and summer in full swing here, it’s a good time to talk about insurance coverage for water sports businesses – specifically works compensation. Owning a water sport business can be fun and a good investment, but you need to hire employees to help the business run smoothly. Be sure you purchase adequate Workers’ Compensation to cover your employees and protect your assets. In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.