Auto insurance is meant to protect you by covering your bills after an accident. However, the amount of compensation can vary greatly depending on the type of claim that’s made by insurance carriers and the value of your vehicle. The decision to have your vehicle repaired or declared a total loss directly impacts how much you receive.

Determining a Claim

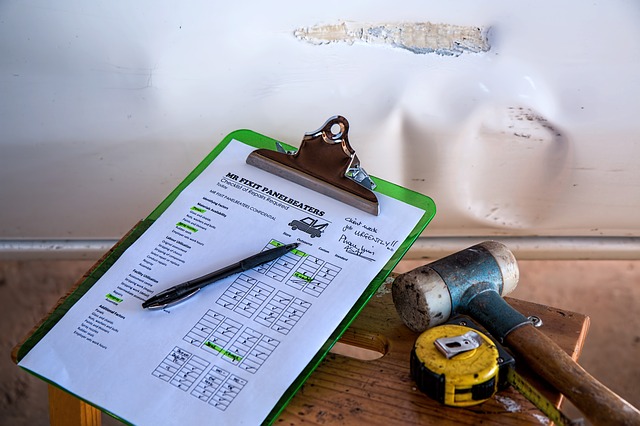

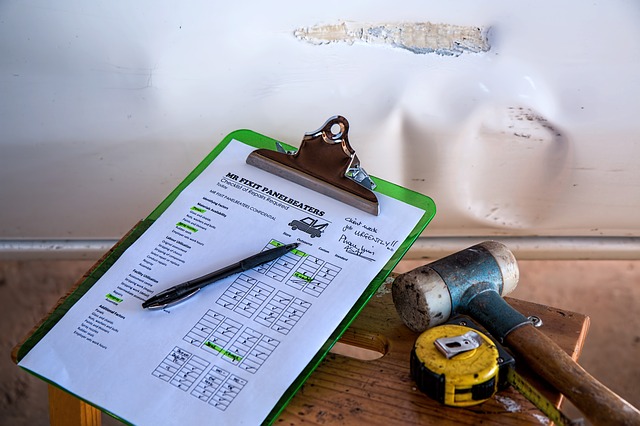

If you’re in an accident, the at-fault driver’s insurance carrier will analyze the approximate value of your vehicle before the accident as well as the cost to repair it afterward. Typically, the pre-accident value of your vehicle is determined by finding its actual cash value. This value is found by taking the price of a similar replacement vehicle in your area and then subtracting any pre-accident depreciation, such as your vehicle’s mileage and history.

If the cost to repair your vehicle is less than its actual cash value, insurers will usually opt to compensate you for the repairs. However, if the cost is too high or if the vehicle can’t be restored to a safe condition, insurers may declare it a total loss.

Total Loss Claims

If your vehicle is declared a total loss, you’ll be compensated with the full actual cash value of your vehicle, minus any applicable policy deductible.

If the cost to re

However, if a financed or loaned vehicle is declared a total loss, the insurer will pay the remaining balance to the finance company first. Here’s a breakdown of the two most common scenarios that occur when a financed vehicle is declared a total loss:

- The actual cash value of the vehicle is greater than the remaining balance of the loan. In this scenario, the insurer pays off the loan and then gives you the amount by which the actual cash value exceeds the loan balance.

- The actual cash value of the vehicle is less than the remaining balance on the loan. In this scenario, you are responsible for the difference between the actual cash value and the remaining loan balance.

Repairs and Diminished Value Claims

Getting a check for the full cost of your vehicle’s repairs may seem like a best-case scenario. However, repairs can substantially reduce your vehicle’s value. Even if it drives better than ever after being repaired, the fact that it was in an accident will taint its history and lead to a lower price if you ever choose to sell it. However, you can file a diminished value claim against an insurance carrier to try to recover any value that’s lost as a result of repairs.

If the cost to re

Most states and insurance contracts prevent policyholders from bringing diminished value claims against their own insurers. However, if another driver is at fault for an accident and his or her insurance pays for your repairs, you may be able to use a diminished value claim to recover any lost value.

If the cost to re

Because few vehicles are appraised immediately before they’re involved in an accident, it can be hard to prove that value has been lost after they’re repaired. Here are some tips you can use before and after an accident to prepare yourself for a successful diminished value claim:

- Check third-party websites to get an approximate value for your vehicle’s make and model.

- Take your vehicle to a pre-owned dealership after an accident for an appraisal. You can then ask for a letter that shows that your vehicle’s lower-than-average value is due to its repairs or accident history.

- Keep documentation about any repairs or enhancements to your vehicle. These documents can help show a more detailed history of your vehicle when determining its value.

- Contact us at 831-661-5697 for more information about diminished value claims and to discuss the specifics of your situation.

Be Prepared

There are few things more dangerous and stressful than getting into an accident. Contact Scurich Insurance today, we can provide you with a variety of auto resources, including our infographic, “5 Things to Do if You Get in a Car Accident.”

Read more

OVERVIEW

The U.S. Court of Appeals for the 7th Circuit has ruled that Title VII of the Civil Rights Act (Title VII) prohibits employment discrimination based on sexual orientation. The decision in Hively v. Ivy Tech, issued on April 4, 2017, makes it illegal to use an individual’s sexual orientation as a basis for employment decisions.

The ruling applies to employers with 15 or more employees in Wisconsin, Illinois and Indiana.

The decision is groundbreaking because it overturned prior cases and also conflicts with law from other federal courts. However, it aligns with the Equal Employment Opportunity Commission’s (EEOC) position. This makes review of the issue by the U.S. Supreme Court likely in the future.

ACTION STEPS

Affected employers should review their existing policies to ensure they do not allow discrimination based on sexual orientation or gender identity. Employers should also review any applicable state laws and the EEOC’s enforcement guidance to ensure their policies are compliant.

Background

Title VII is a federal law that prohibits employers with 15 or more employees from discriminating against employees and job applicants on the basis of their race, color, religion, sex or national origin. Since Title VII was enacted in 1964, several federal courts, including the 7th Circuit, have held that the law’s inclusion of the word “sex” means that its protections only extend to traditional notions of gender.

For example, the 7th Circuit’s 1984 decision in Ulane v. Eastern Airlines had held that Title VII only makes it unlawful to discriminate “against women because they are women and against men because they are men.” The U.S. Court of Appeals for the 11th Circuit (which includes Alabama, Florida and Georgia) recently issued a similar holding in its March 2017 decision in Evans v. Georgia Regional Hospital.

Although the U.S. Supreme Court has never specifically addressed whether Title VII prohibits discrimination based on sexual orientation, its decisions in other cases have established that:

- The practice of “gender stereotyping” falls within Title VII’s prohibition against sex discrimination; and

- Discrimination based on the race of a person with whom another individual associates is a form of racial discrimination under Title VII.

Relying on these and other Supreme Court decisions in its ruling in Hively v. Ivy Tech, the 7th Circuit expressly overturned all of its prior case law that had excluded sexual orientation from Title VII. Instead, the 7th Circuit held, “a person who alleges that she experienced employment discrimination on the basis of her sexual orientation has put forth a case of sex discrimination for Title VII purposes.” The court further specified that “it is impossible to discriminate on the basis of sexual orientation without discriminating on the basis of sex.”

Hively v. Ivy Tech

In 2013, Kimberly Hively, an openly gay woman who had worked as a part-time adjunct professor, filed a Title VII discrimination charge against her former employer, Ivy Tech Community College. Hively alleged that because she was gay, Ivy Tech had rejected her for six full-time positions and refused to renew her part-time employment contract. She argued that these actions constituted unlawful discrimination based on sex under Title VII.

A district court dismissed her case based on prior federal court interpretations of Title VII’s prohibition against sex discrimination. Hively then appealed to the 7th Circuit, which ruled in her favor on April 4, 2017. Under its comparative analysis, the court concluded that Hively’s claim involved discrimination based on her failure to conform to a heterosexual female stereotype. According to the court, this made Hively’s claim “no different from the claims brought by women who were rejected for jobs in traditionally male workplaces, such as fire departments, construction and policing.”

The 7th Circuit also compared Hively’s claims to cases in which the Supreme Court held that employers may not discriminate against an individual based on the race of his or her associates. Noting that the Supreme Court has held that this type of discrimination affects both partners in an interracial marriage, the 7th Circuit applied the same reasoning to Hively’s situation.

Considerations for Employers

While the 7th Circuit’s decision overturned the court’s prior cases to clarify how the federal law applies in the three states under its jurisdiction, two of those states (Wisconsin and Illinois), along with 20 other states in the United States, have already passed laws outlawing sexual orientation discrimination in employment. In addition, the EEOC, which is responsible for the enforcing Title VII, has taken a position that aligns with the 7th Circuit’s decision since 2015. Specifically, the EEOC already interprets and enforces Title VII’s prohibition against sex discrimination as forbidding any employment discrimination based on sexual orientation or gender identity.

Therefore, employers should be aware that the 7th Circuit’s decision does not necessarily represent a radical shift in the law. Instead, the decision merely reinforces the fact that employers may be penalized for discriminating against individuals based on sexual orientation or gender identity. More information about the EEOC’s enforcement policy is available on the EEOC’s website.

The 7th Circuit’s decision provides additional guidance for employers as well. For example, the court stated that “any discomfort, disapproval or job decision based on the fact that a complainant—woman or man— dresses differently, speaks differently, or dates or marries a same-sex partner, is a reaction purely and simply based on sex.”

Finally, employers should be aware that the 7th Circuit’s decision does not address the meaning of sex discrimination in the context of social or public services, nor in the context of employment related to a religious mission. In addition, the issue addressed in the case may undergo review by the U.S. Supreme Court in the near future. Therefore, employers should continue to watch for legal developments affecting Title VII.

Read more

During a recent visit to Wisconsin, President Donald Trump vowed to defend American dairy farmers who’ve been affected by Canada’s trade practices. Canada’s dairy sector is protected by high tariffs and controls on domestic production to support prices that farmers receive.

Last year, Canada’s dairy farmers agreed to sell milk ingredients used for cheesemaking to Canadian processors at prices competitive with international rates. Industry groups in New Zealand, Australia, the European Union, Mexico and the United States complained the new, competitive prices undercut exports to Canada.

The U.S. dairy industry groups want Trump to urge Prime Minister Justin Trudeau to end Canada’s pricing policy that has disrupted many U.S. dairy exports. They’re also asking for a prioritization of dairy market access in North American Free Trade Agreement talks. Trump has already threatened to eliminate the trade agreement with Canada if it doesn’t change its trade policies.

Ottawa’s ambassador David MacNaughton blames U.S. producers’ problems on overproduction rather than Canadian policy. The Dairy Farmers of Canada said it was confident that Ottawa would continue to protect and defend the dairy industry.

Pace of Corn Planting is Behind

According to the U.S. Department of Agriculture’s weekly Crop Progress Report, every corn-producing state in America is behind last year’s planting pace, with the exception of Indiana.

The state lagging behind the most is Missouri, with only 17 percent of its corn crop planted as of Easter Sunday. At the same time last year, Missouri farmers had planted 53 percent of the state’s corn crop.

North Dakota, South Dakota, Michigan, Wisconsin and Ohio didn’t have planting data listed in the Crop Progress Report at the time of publication.

Planting Safety Tips

As farmers prepare for planting season, it is worth remembering the following safety tips:

- Be mindful while transporting goods on public roadways.

- Watch for children, as they’re often attracted to large, noisy equipment.

- Follow instruction labels when applying products such as pesticide, herbicide or fungicide. Consider keeping photos of the instructions on your smartphone for convenience.

- Service all farm equipment regularly.

- Store fuel away from machine sheds and other buildings.

- Get adequate amounts of sleep, and follow a healthy diet.

Read more

When the project is finished, it belongs to the client, it belongs to whoever owns the land. In the meantime, there’s a lot of shared risk. If a hurricane blows the whole jobsite into the sea, the client is out whatever you’ve spent on construction materials, but the builder could be out of a job if there’s no builder’s risk policy in place to recover the losses.

The builder does the work, the client finances the project, and until it’s finished, you’re in this together, sharing the risks associated with building something. Their project and your job are both on the line.

So who buys the builder’s risk insurance?

Many contractors insist on the client making the purchase. It’s the client that collects the payout on the claim, it’s the client who will own the finished property, and all the material on the site has been purchased with funds allocated by the client. This is the simplest, easiest solution. Anyways, if the builder is expected to buy the policy, then they’re probably going to weigh that into the budgeting process, essentially requiring the client to foot the bill either way.

On the other hand, buying the policy yourself, as a builder, can help to protect you against certain circumstance. Suppose, for instance, that disaster strikes, and it kills the client’s enthusiasm for the project. They recoup their losses, and leave you out of a job. Furthermore, a builder may simply be more familiar with the ins and outs of insuring a construction project. If you’re working with someone who is new to the process or someone who just wants a home built and isn’t interested in becoming a real estate mogul, then it may make more sense to handle all the red tape for them.

You’re generally going to have to provide proof of builder’s risk coverage on most major projects, and if you already know how to do that, it’s a lot easier than telling someone where to go to get these papers stamped, who to call for a fair price on the policy, how much coverage to buy and so on.

Ultimately it depends on the project. If the client is trustworthy and experienced in these matters, then you may want to let them handle it. Otherwise, you can streamline the process and get to work much quicker by buying the policy yourself rather than walking an inexperienced client through it.

Read more

Safety in your everyday small business operations is essential for your employees, customers and success. Understanding and maintaining safety guidelines can be challenging, though. OSHA offers numerous resources that benefit your company. Take advantage of these resources as you ensure your small business maintains safety guidelines and stays compliant with current laws at all times.

OSHA’s Cooperative Programs

Your small business must cooperate with OSHA to maintain safety and remain compliant with laws, but you may not know where to start. OSHA offers five cooperative programs that help your small business prevent workplace injuries, illnesses and fatalities. Available programs include:

- Alliance Program

- OSHA Strategic Partnership Program (OSPP)

- Voluntary Protection Programs (VPP)

- OSHA Challenge Program

- On-site Consultation Program’s Safety and Health Achievement Recognition Program (SHARP)

All states with OSHA-approved programs offer this cooperative program option, and you can search the website to learn more about each program.

On-Site Consultation Program

Get personalized advice with a free and confidential on-site consultation. The consultant will not give penalties or citations because the purpose of the consultant’s visit is solely to:

- Identify workplace hazards

- Share advice on how to become compliant with OSHA guidelines

- Implement injury and illness prevention programs

While the program prioritizes high-hazard worksites, it’s available to all small and medium-sized businesses and is completely free.

Diverse Workforce/Limited English Proficiency Coordinators

When your workforce employs Spanish speakers or a diverse workforce, you may need education, outreach and training assistance. Schedule a seminar or workshop with an OSHA Diverse Workforce/Limited English Proficiency coordinator. Every 10 OSHA regions has one coordinator who can help you train and prepare your employees effectively.

Compliance Assistance Specialists (CAS)

When you’re ready to host a seminar or workshop on safety challenges or compliance issues, contact a CAS. In states under federal jurisdiction, the OSHA area offices have a CAS on staff who will provide training resources and promote OSHA cooperative programs.

Training Institute (OTI) and Training Education Centers

Access a variety of OSHA trainings, including technical advice, seminar and workshop speakers, or audiovisual aids, through the Training Institute and Training Education Centers. This resource provides basic and advanced safety and health courses as well as small business seminars.

Penalty Reductions

Non-compliance with OSHA guidelines can result in large penalties. However, your small business’s size and number of employees may reduce the penalties. Learn more as you assess your eligibility for penalty reductions.

OSHA safety guidelines protect your employees and small business since they reduce injuries, illnesses and fatalities. OSHA guidelines can be confusing, though. Maintain compliance when you take advantage of these OSHA resources. They help your small business remain safe and successful.

Read more

Choosing the right respirator relevant to the nature of the employment is critical to a worker’s safety. Exposure to different hazards means that not just any respirator will suffice.

Two main classes of respirators are available:

Air-Purifying Respirators (APR)

These respirators are designed to filter air borne contaminants such as fumes or noxious dust. Other forms of APR models use a canister or cartridge containing a material that absorbs the contaminants.

APRs are tight fitting to the face and have different designs. These designs include particulate respirators, powered air-purifying respirator (PAPR), gas masks and chemical cartridge respirators. They come in four different designs, including:

Full Face Piece

Fully covers the face from underneath the chin to an area above the eyes. This feature provides added protection to the eyes, especially from chemical irritants.

Half-Face Mmask

Gives protection from beneath the chin to and including the nostrils.

Quarter-Mask – Protects the Mouth and Nose.

Mouth bit respirator – Normally used for escaping a hazardous situation only. Contains a bit which is inserted into the mouth and nose clip to seal the nostrils closed.

Supplied-air respirator (SAR)

These respirators provide breathable air via an air line or a compressed work tank. SARs come in two different types. The first has a loose fitting respiratory inlet, such as a helmet or a hood which envelopes both the neck and head, that is supplied purified air through airlines. This type may have face pieces which fit loosely.

The other form of SAR has either a half or full face piece and has very snug respiratory inlets.

Choosing the Most Suitable Respirator

Selecting the most suitable respirator must be performed by an expert, such as a safety professional. The expert will consider the appropriate apparatus only after they have identified and evaluated the potential respiratory hazard and considered the relative limitations of the respiratory apparatus for the situation.

Key Questions to Ask

Here are some factors an employer should consider when determining whether a respirator may be required:

Establish the existence of a hazard by considering warnings about the material, like its chemical components or the nature of the particulates that might be released through the work performed.

Determine whether there is limited oxygen present.

Is the hazard airborne such as a particulate, fume, or vapor?

Ask whether the respirator will be used for an emergency or in combating fires.

Evaluate whether the work is strenuous and will be performed in hazardous atmospheric circumstances.

Is there any agent present which might be possibly fatal, carcinogenic, skin absorbable or acts as an irritant?

Will the work be conducted in a confined space or will the worker be exposed to abnormal temperatures?

The key is that respirators should be used to suit the work. The proper choice of respirator is vital to the health and safety of workers in many types of employment.

Read more