Auto insurance is meant to protect you by covering your bills after an accident. However, the amount of compensation can vary greatly depending on the type of claim that’s made by insurance carriers and the value of your vehicle. The decision to have your vehicle repaired or declared a total loss directly impacts how much you receive.

Determining a Claim

If you’re in an accident, the at-fault driver’s insurance carrier will analyze the approximate value of your vehicle before the accident as well as the cost to repair it afterward. Typically, the pre-accident value of your vehicle is determined by finding its actual cash value. This value is found by taking the price of a similar replacement vehicle in your area and then subtracting any pre-accident depreciation, such as your vehicle’s mileage and history.

If the cost to repair your vehicle is less than its actual cash value, insurers will usually opt to compensate you for the repairs. However, if the cost is too high or if the vehicle can’t be restored to a safe condition, insurers may declare it a total loss.

Total Loss Claims

If your vehicle is declared a total loss, you’ll be compensated with the full actual cash value of your vehicle, minus any applicable policy deductible.

If the cost to re

However, if a financed or loaned vehicle is declared a total loss, the insurer will pay the remaining balance to the finance company first. Here’s a breakdown of the two most common scenarios that occur when a financed vehicle is declared a total loss:

- The actual cash value of the vehicle is greater than the remaining balance of the loan. In this scenario, the insurer pays off the loan and then gives you the amount by which the actual cash value exceeds the loan balance.

- The actual cash value of the vehicle is less than the remaining balance on the loan. In this scenario, you are responsible for the difference between the actual cash value and the remaining loan balance.

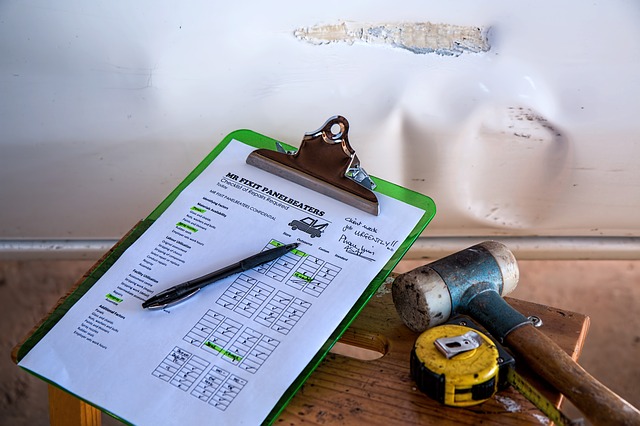

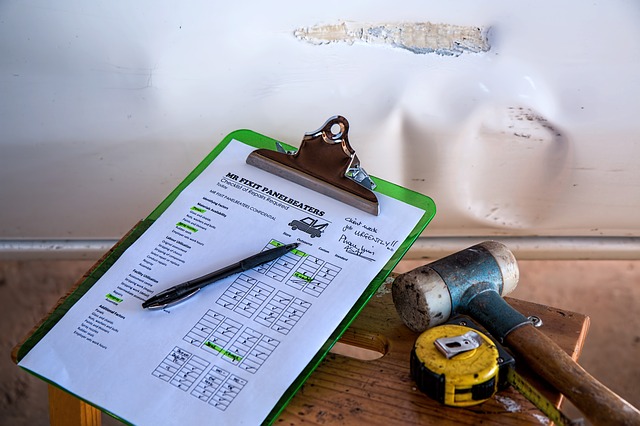

Repairs and Diminished Value Claims

Getting a check for the full cost of your vehicle’s repairs may seem like a best-case scenario. However, repairs can substantially reduce your vehicle’s value. Even if it drives better than ever after being repaired, the fact that it was in an accident will taint its history and lead to a lower price if you ever choose to sell it. However, you can file a diminished value claim against an insurance carrier to try to recover any value that’s lost as a result of repairs.

If the cost to re

Most states and insurance contracts prevent policyholders from bringing diminished value claims against their own insurers. However, if another driver is at fault for an accident and his or her insurance pays for your repairs, you may be able to use a diminished value claim to recover any lost value.

If the cost to re

Because few vehicles are appraised immediately before they’re involved in an accident, it can be hard to prove that value has been lost after they’re repaired. Here are some tips you can use before and after an accident to prepare yourself for a successful diminished value claim:

- Check third-party websites to get an approximate value for your vehicle’s make and model.

- Take your vehicle to a pre-owned dealership after an accident for an appraisal. You can then ask for a letter that shows that your vehicle’s lower-than-average value is due to its repairs or accident history.

- Keep documentation about any repairs or enhancements to your vehicle. These documents can help show a more detailed history of your vehicle when determining its value.

- Contact us at 831-661-5697 for more information about diminished value claims and to discuss the specifics of your situation.

Be Prepared

There are few things more dangerous and stressful than getting into an accident. Contact Scurich Insurance today, we can provide you with a variety of auto resources, including our infographic, “5 Things to Do if You Get in a Car Accident.”

Read more

If you’ve just bought a recreational vehicle. and can’t wait to get on the road. will Auto insurance protect your pride and joy?

If you’ve just bought a recreational vehicle. and can’t wait to get on the road. will Auto insurance protect your pride and joy?

That depends. You might want to get an endorsement to your Auto policy that would provide coverage. However, since your R. means so much more to you than just transportation, it’s best to get specialized insurance that a typical Auto policy won’t cover. Recreational Vehicle insurance combines Auto, Homeowners, Renters, and Travel coverages into a single policy that will also insure generators, water pumps and refrigerators – items that standard Auto or Homeowners policies would not cover.

The amount of coverage will depend on the value of the RV and its contents, as well as your driving record.

Before you hit the open road, give us a call our office for a comprehensive policy on your vehicle so that you can get behind the wheel with peace of mind.

Happy trails!

Read more

You’re at the airport car rental counter to find a convertible for the weekend — for business, of course. “No problem,” says the sales rep. But before handing you the keys, she asks if you’d like additional Physical Damage coverage. This leaves you with a problem: Should you pay the extra money or trust your own insurance?

You’re at the airport car rental counter to find a convertible for the weekend — for business, of course. “No problem,” says the sales rep. But before handing you the keys, she asks if you’d like additional Physical Damage coverage. This leaves you with a problem: Should you pay the extra money or trust your own insurance?

Your Business Auto insurance will probably pay for your liability on the business rental, but coverage for damage to the rental vehicle can be more complicated. You might be covered under your Business Auto or Personal Auto policy, or even the credit card that you used to pay for the rental, Depending on the situation, it’s also possible that none of them will pay very much.

To make things even more confusing, laws in a number of states limit your responsibility for damage to the rental – if coverage applies under any of the above, there might still be exclusions and limitations.

To help cut through this confusion, here are a few tips:

- Rent from a reputable company. The national car rental firms tend to have standardized contracts with tested language. Local or smaller businesses often develop their own contracts, and without legal assistance it might be nearly impossible to determine exactly what you’ve agreed to.

- When in doubt, ask. The person at the rental counter might not be sure about what coverage she’s selling, so be sure to ask to speak to someone who can clearly explain what you are and are not responsible for. If you’re unsure, walk away.

- Talk with us before your trip. We’d be happy to explain your options.

Read more

You know the drill after an auto crash, heart stopping panic, and then, especially if there’s major damage or a serious injury, exchanging names, addresses and insurance information with the other driver. Easy, right?

You know the drill after an auto crash, heart stopping panic, and then, especially if there’s major damage or a serious injury, exchanging names, addresses and insurance information with the other driver. Easy, right?

However, if the other driver refuses to provide these particulars (or you’re so shaken that you forget to ask for them), you could end up in serious financial, or even legal, trouble.

Dan Young, Senior Vice President of Insurance Relations for CARSTAR warns, “[After an accident] sometimes drivers just don’t do what they’re supposed to do.”

To make sure you’re prepared for such a mishap, follow these guidelines:

- Remain at the scene. Although state laws differ, failure to exchange information or notify police can lead to a hit-and-run charge or loss of your license.

- Keep a “cheat sheet” in your glove compartment about what to ask after an accident.

- Use your cellphone to take a photo of the other vehicle, (preferably showing its license plate) as visual proof of the incident.

- Write down details. As soon as you and your vehicle are out of traffic and harm’s way, record the date and time, location, make and model of the cars and actions or statements by the other driver.

- Ask any bystanders or eyewitnesses for their names and contact information.

In the meantime, review your auto policy to make sure that you carry: 1) collision coverage, which will pay for repairing your car and providing a replacement vehicle, if needed and 2) uninsured/underinsured motorists insurance (UM/UIM), which will cover damages for injuries caused by an uninsured or underinsured driver.

For more information, feel free to get in touch with our agency

Read more

As you go about your daily business, insurance fraud is probably one of the furthest things from your mind. However these all-too-common scams, everything from homeowners who report a non-existent burglary to collect on their policies to drivers who stage auto accidents and file injury claims – are criminal acts that you have a legal obligation to report.

As you go about your daily business, insurance fraud is probably one of the furthest things from your mind. However these all-too-common scams, everything from homeowners who report a non-existent burglary to collect on their policies to drivers who stage auto accidents and file injury claims – are criminal acts that you have a legal obligation to report.

If you’re aware of, or suspect, a fraudulent act that involves insurance follow these steps:

- Inform the insurance fraud bureau in your state either through its telephone “hot line” or online.

- Contact the fraud department of the insurance company involved. Most companies have hotlines for this purpose. If a fraud hotline isn’t available, or if you’re uncomfortable using it, write the fraud department instead.

- If the alleged fraud involves a medical issue – such as a claim for a non-existent condition – contact your state medical board or chiropractic board immediately in order to protect the complainant, as well as other possible victims.

- If appropriate, notify other authorities, such as the police (if someone’s life might be in danger) or your local Social Security office (in case of suspected Social Security fraud).

- Remember that, as a witness, you must report all the details involved: full names, dates, organization, company name, the amount of money involved, etc. Provide any documentation or other information you think might help with the investigation.

- Be patient. Investigating complaints takes time; it might be months before the investigators have gathered enough evidence to bring the perpetrators into court.

A word to the wise. insurance scams costs billions of dollars a year, driving up premiums for everyone – including you.

Read more

Adding a teenager to your auto policy can raise your rate by more than 40%. The good news: you and your teen can reduce these hikes significantly in a variety of ways:

Adding a teenager to your auto policy can raise your rate by more than 40%. The good news: you and your teen can reduce these hikes significantly in a variety of ways:

- Get good grades. Most insurance companies offer high school or college students with a B average or better a discount of up to 10%.

- Live away from home. Students at college or living at least 100 miles from their parents without a car can usually get a 5%-10% discount.

- Take an additional driving class. Although most insurance companies don’t give a discount for mandatory drivers’ed instruction, some companies will reduce premiums by 5% for teens who go to follow-up classes.

- Sign a parent-teen driving contract. Your insurer might offer up to a 5% discount if your teen agrees to follow such rules as not driving at night or with friends in the car.

- Raise your deductible. However, bear in mind that you’ll have to pay this deductible if your teen driver damages the car. If you repair every ding, you could spend a lot more than you’ll save on premiums with a higher deductible.

- Reduce or drop some coverage. If you have an older car, you might not need Comprehensive or Collision insurance. Be wary of lowering Liability limits. In most cases, it makes sense to keep Personal Injury Protection (PIP) coverage, which pays medical expenses of anyone injured in an auto accident.

- Choose a safe vehicle. The higher the safety rating of your car, the lower your premiums – and the safer your teenager will be behind the wheel.

We’d be happy to help you minimize the sticker shock of adding a teen driver. Just give us a call.

Read more

If you’ve just bought a recreational vehicle. and can’t wait to get on the road. will Auto insurance protect your pride and joy?

If you’ve just bought a recreational vehicle. and can’t wait to get on the road. will Auto insurance protect your pride and joy?

As you go about your daily business, insurance fraud is probably one of the furthest things from your mind. However these all-too-common scams, everything from homeowners who report a non-existent burglary to collect on their policies to drivers who stage auto accidents and file injury claims – are criminal acts that you have a legal obligation to report.

As you go about your daily business, insurance fraud is probably one of the furthest things from your mind. However these all-too-common scams, everything from homeowners who report a non-existent burglary to collect on their policies to drivers who stage auto accidents and file injury claims – are criminal acts that you have a legal obligation to report.