If pets are part of your family, you schedule regular veterinary visits to ensure the health of your furry friends. Consider additional protective steps you can take during Pet Insurance Month, observed in September.

What is Pet Insurance?

Similar to health insurance for humans, pet insurance helps you pay for the expected and unexpected health care your pet needs. You may choose from a variety of policies.

- Accident – Pay for the treatment of unexpected accidents or injuries like animal bites or poisoning but not illnesses or diseases.

- Accident and Illness – Treat broken bones, ear infections, diabetes, and other accidents, sicknesses, diseases, and pet health changes.

- Routine, Preventative Care or Wellness – Cover annual exams, vaccinations, flea control, and teeth cleaning.

You may also purchase endorsements or riders. They cover specific issues that aren’t included in your regular policy.

Your policy will include limits, too. Choose the annual, lifetime, per condition, or unlimited lifetime limit as you prepare to provide your pet with the best possible care.

Keep in mind that pet insurance includes exclusions based on your pet’s age, breed and hereditary conditions. Your policy could also be denied because of a pre-existing condition, such as a diagnosed illness or disease.

Review your policy carefully to ensure it meets your needs. For example, ensure the policy covers cancer treatment before you schedule the procedure so you’re not surprised by a denied claim after your next vet visit.

How do you use Pet Insurance?

Pet insurance allows you to see the veterinarian of your choice. You’ll pay the veterinarian out-of-pocket and then submit a claim to your pet insurance company. After you pay your deductible and any co-payment, you’ll receive reimbursement as per your policy terms.

How much does Pet Insurance Cost?

Your pet’s age and breed affect your pet insurance costs. Other factors include your location, the type of policy you purchase, the deductible, benefit limit, and reimbursement percentage. Discuss your needs and budget with your insurance agent as you purchase the right coverage for your pet.

Why Would you Purchase Pet Insurance?

Ultrasounds, blood work, dermatology treatment, and other medical and surgical procedures can cost thousands of dollars. With insurance, you can afford the treatment your pet needs. It also allows you to seek medical treatment as soon as possible rather than put off diagnostic or treatment visits. You can and insurance to choose treatment rather than euthanasia for your beloved pet, too.

During Pet Insurance Month, learn how to enhance your pet’s quality of life and give your furry friend the medical treatment it needs and deserves. This valuable product protects your pet and could save its life.

Read more

Renting a vacation house saves you big bucks on vacation since it’s usually cheaper per night than a hotel. Plus, you have amenities like a washer and dryer, kitchen, full bath and maybe even a large backyard. That doesn’t mean, though, that your vacation home is perfect. Like any home, it’s susceptible to thieves, weather damage or other problems.

Renting a vacation house saves you big bucks on vacation since it’s usually cheaper per night than a hotel. Plus, you have amenities like a washer and dryer, kitchen, full bath and maybe even a large backyard. That doesn’t mean, though, that your vacation home is perfect. Like any home, it’s susceptible to thieves, weather damage or other problems.

You might want to invest in insurance coverage as you rent a vacation home this summer.

Make Sure the Landlord and/or Rental Company (AirBnB) has adequate Property Insurance

You don’t plan to go on vacation and have a terrible time, but accidents, bad weather and mistakes happen. Who will pay the bill if the home’s rotted stair railing fails and sends you tumbling off the steps and into the ER? Can you afford to replace an antique vase you or one of your kids accidentally breaks?

In most cases, the landlord’s insurance will cover these accidents. Always ask if the home is covered before you sign a rental agreement, though, to ensure you’re not left covering the bill that should be the vacation home owner’s responsibility.

Make Sure you Have Insurance

Most homeowner and renters insurance policies cover your belongings if they’re lost, stolen or damaged. This coverage applies whether you’re in your home, at school or at vacation.

It’s a good idea to double check your policy before you travel. Add additional coverage if necessary to ensure you are indeed covered for every possible scenario. Ensure the policy is current and paid in full, too. You don’t want to file a claim while on vacation and discover that your coverage lapsed.

Renting a house can be an affordable, comfortable and fun part of your next vacation. Before you sign a lease agreement, make sure the home and your possessions are insured. The peace of mind helps you truly relax and unwind no matter where your vacation takes you.

Read more

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Who Is Susceptible?

Those most at risk are workers whose job requires them to be outdoors. These include construction workers, HVAC workers, roofers, landscapers and many others. However, there are other jobs, such as automobile sales people, that may seem like an indoor job but actually require time outdoors. Even traditional office workers can succumb to heat if they are required to exert themselves too much during times of warm weather. For example, moving boxes or supplies from storage sheds or walking long distances between buildings.

Preventing Heat Related Illnesses

Preventing heat exhaustion is simply a matter of remembering to take it easy during hot weather. Employees should avoid exerting themselves beyond the physical activity that they are accustomed to. Additionally, they should take frequent breaks in a shady, cool location, especially if they begin to feel weak. Employers can help by supplying adequate drinking water and sports drinks, which can help re-balance electrolytes lost through sweating. Workers such as landscapers and roofers who must be outside, should schedule work as early as possible to avoid the hottest times of the day.

Signs of Heat Exhaustion

Employers and workers must be watchful for signs that someone is experiencing heat exhaustion, as many individuals will continue to push themselves even when lightheaded or weak. Symptoms include headache, blurred vision, nausea, paleness, excessive sweating, a weak pulse and shallow breathing. In severe cases, the individual will pass out. If these symptoms occur, force the individual to stop working, move them to an indoor location with air conditioning and make them lay down. A cool drink of water or a sports drink should also be given in small sips. If symptoms don’t subside within 15 to 20 minutes, call the paramedics.

Read more

10 months ago

·

by

Erin Carlson ·

0 comments

Dear Valued Client,

As Independence Day approaches, we wanted to take a moment to reach out and extend our warmest wishes for a joyous and memorable July 4th celebration.

First and foremost, we hope that this message finds you and your loved ones safe and in good health.

While this year’s celebrations may still carry some restrictions and precautions, we encourage you to make the most of the festivities. Whether you choose to enjoy a backyard barbecue, watch a breathtaking fireworks display, or spend quality time with your family and friends, we hope that you find joy and happiness in every moment.

We also want to take a moment to express our heartfelt gratitude for your continued trust and support. Our relationship with our esteemed clients, is the cornerstone of our success. It is through your partnership that we are able to strive for excellence and deliver the best service possible. Please know that we value your patronage deeply and look forward to continuing to serve you with the utmost dedication in the months and years to come.

May your day and weekend be filled with laughter, love, and cherished memories. As we look ahead to a brighter future, let us embrace the spirit of unity and optimism that this day represents.

Happy Independence Day!

Warmest regards,

Tony and the Scurich Insurance Team

Read more

10 months ago

·

by

Erin Carlson ·

0 comments

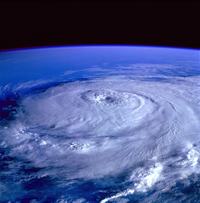

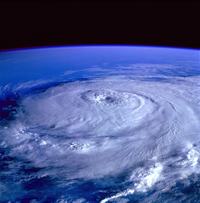

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

Acts of God will exempt a party from strict liability and from negligence in common law. Many building contracts have a provision allowing for acts of God to excuse unexpected delays in a project’s completion. However, damages and delays owing to a natural disaster may be disputed as acts of God in some circumstance.

The key word is “unforeseeable.” If someone falls off of a scaffolding and spends the next four weeks in a cast because of an earthquake, then that will usually be chalked up to an act of God. If they saw a storm coming in, decided to keep working, and then got struck by lightning, then the “act of God” claim may be contested.

“Act of God” is sort of a liability free-pass card, exempting you from responsibility for things that you couldn’t possibly have predicted. There are a few steps that you can take to ensure that there is no gray area, no room for doubt when you need to lean on this legal term:

- Keep tabs on the weather. Don’t assume, for instance, that a storm “isn’t going to be as bad as they say.” It might not be so bad, but do you want to bet your career on it?

- Keep all of your safety equipment in tip top shape. You don’t want to give people any wiggle room to say that that safety harness would have snapped eventually with or without the earthquake.

- This goes for your vehicles, as well. It’s hard to claim a small flood as an “act of God” when your truck was the only one slipping and sliding across the road.

An act of God can be a sort of Get Out Of Jail Free card when it comes to liability, but you can’t play it every time.

Read more

11 months ago

·

by

Erin Carlson ·

0 comments

Summertime fun often includes swimming in the pool. Whether you already have a pool in your backyard or are thinking about putting one in this year, you may wonder if your home insurance will cover your pool.

Summertime fun often includes swimming in the pool. Whether you already have a pool in your backyard or are thinking about putting one in this year, you may wonder if your home insurance will cover your pool.

Personal Liability Coverage

If someone is injured while swimming in your pool, the personal liability coverage on your homeowners insurance policy will pay for it. Update this coverage amount when you install your pool to ensure it’s sufficient.

Related Structure Coverage

Your insurance company may classify your new in-ground pool as a related structure, similar to a storage shed or detached garage. Increase the related structure coverage on your homeowners insurance policy to cover damage to your pool. Keep in mind that this coverage won’t pay for pool maintenance.

Geography Matters

Find the majority of backyard pools in warm climates. Based on this fact, insurance costs for your pool may be cheaper if you live in the warmer southern states and more expensive if you live in cooler northern states.

Erect a Fence

To prevent accidents in the pool, many insurance companies stipulate that you surround your pool with a fence that includes a self-latching gate. Consider whether or not you have the space and ability to erect a fence before you install a pool.

Consider the Diving Board or Slide

Some insurance companies won’t cover accidents that happen on the diving board or slide. That policy will influence whether or not you install one of those pool accessories.

Consider an Umbrella Policy

Even if your homeowners insurance policy covers your pool, consider an umbrella policy. It provides extra coverage after your homeowners insurance limits are met. The extra protection gives you peace of mind if you need to file any pool-related claims.

A backyard pool provides hours of fun every summer. Before you install one, though, talk to your insurance agent. Get all the facts.

Read more

Renting a vacation house saves you big bucks on vacation since it’s usually cheaper per night than a hotel. Plus, you have amenities like a washer and dryer, kitchen, full bath and maybe even a large backyard. That doesn’t mean, though, that your vacation home is perfect. Like any home, it’s susceptible to thieves, weather damage or other problems.

Renting a vacation house saves you big bucks on vacation since it’s usually cheaper per night than a hotel. Plus, you have amenities like a washer and dryer, kitchen, full bath and maybe even a large backyard. That doesn’t mean, though, that your vacation home is perfect. Like any home, it’s susceptible to thieves, weather damage or other problems. Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.  In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend. Summertime fun often includes swimming in the pool. Whether you already have a pool in your backyard or are thinking about putting one in this year, you may wonder if your home insurance will cover your pool.

Summertime fun often includes swimming in the pool. Whether you already have a pool in your backyard or are thinking about putting one in this year, you may wonder if your home insurance will cover your pool.