10 months ago

·

by

Erin Carlson ·

0 comments

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Who Is Susceptible?

Those most at risk are workers whose job requires them to be outdoors. These include construction workers, HVAC workers, roofers, landscapers and many others. However, there are other jobs, such as automobile sales people, that may seem like an indoor job but actually require time outdoors. Even traditional office workers can succumb to heat if they are required to exert themselves too much during times of warm weather. For example, moving boxes or supplies from storage sheds or walking long distances between buildings.

Preventing Heat Related Illnesses

Preventing heat exhaustion is simply a matter of remembering to take it easy during hot weather. Employees should avoid exerting themselves beyond the physical activity that they are accustomed to. Additionally, they should take frequent breaks in a shady, cool location, especially if they begin to feel weak. Employers can help by supplying adequate drinking water and sports drinks, which can help re-balance electrolytes lost through sweating. Workers such as landscapers and roofers who must be outside, should schedule work as early as possible to avoid the hottest times of the day.

Signs of Heat Exhaustion

Employers and workers must be watchful for signs that someone is experiencing heat exhaustion, as many individuals will continue to push themselves even when lightheaded or weak. Symptoms include headache, blurred vision, nausea, paleness, excessive sweating, a weak pulse and shallow breathing. In severe cases, the individual will pass out. If these symptoms occur, force the individual to stop working, move them to an indoor location with air conditioning and make them lay down. A cool drink of water or a sports drink should also be given in small sips. If symptoms don’t subside within 15 to 20 minutes, call the paramedics.

Read more

10 months ago

·

by

Erin Carlson ·

0 comments

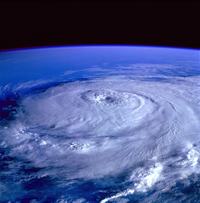

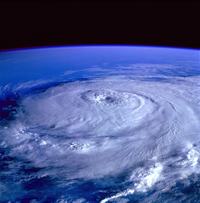

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

Acts of God will exempt a party from strict liability and from negligence in common law. Many building contracts have a provision allowing for acts of God to excuse unexpected delays in a project’s completion. However, damages and delays owing to a natural disaster may be disputed as acts of God in some circumstance.

The key word is “unforeseeable.” If someone falls off of a scaffolding and spends the next four weeks in a cast because of an earthquake, then that will usually be chalked up to an act of God. If they saw a storm coming in, decided to keep working, and then got struck by lightning, then the “act of God” claim may be contested.

“Act of God” is sort of a liability free-pass card, exempting you from responsibility for things that you couldn’t possibly have predicted. There are a few steps that you can take to ensure that there is no gray area, no room for doubt when you need to lean on this legal term:

- Keep tabs on the weather. Don’t assume, for instance, that a storm “isn’t going to be as bad as they say.” It might not be so bad, but do you want to bet your career on it?

- Keep all of your safety equipment in tip top shape. You don’t want to give people any wiggle room to say that that safety harness would have snapped eventually with or without the earthquake.

- This goes for your vehicles, as well. It’s hard to claim a small flood as an “act of God” when your truck was the only one slipping and sliding across the road.

An act of God can be a sort of Get Out Of Jail Free card when it comes to liability, but you can’t play it every time.

Read more

Home invasions and vandalism is on the rise. As many as one in five homes are invaded annually in the United States. One tool thieves use is lock bumping. They use a bump or rapping key to unlock pin tumbler locks and gain access to your home. Learn about lock bumping as you take steps to secure your home and peace of mind.

How Lock Bumping Works

Typically, you can only open a door with a key that’s specific to that lock. The key’s design aligns with the lock, pushes the pins into place above the shear line and unlocks the door. A bump key is designed to also unlock a door except the thief inserts it into the keyhole and taps the key with a screwdriver or hammer. The bumping pushes the pins in the lock above the shear line and pops the lock.

Thieves can easily learn how to make a bump key thanks to numerous online how-to videos and instructions. With a collection of 10 different bump keys, they can open 90 percent of the doors in the U.S., and the entire process takes a few seconds. Tips That Protect Your Home From Lock Bumping

Protect your home and prevent lock bumping with several steps.

- Buy a different pin tumbler lock. Certain locks are harder to bump. When shopping for new locks, look for ones that are:

- Made with security pins

- Not made from hardened steel

- Designed with programmable side bars and not top pins

- Equipped with a trap pin

- Shallow drilled where one of the interior pins is slightly shallower than the others

- Change the spring tension. Stronger top springs in the lock make bumping harder, so ask a locksmith to make at least two of the top springs firmer.

- Replace the traditional pin tumbler lock. Instead, invest in a disk tumbler, time, combination, electronic or electromagnetic lock. They don’t contain pins and are less vulnerable to bumping.

- Reinforce existing locks. If you don’t want to replace all the locks in your home, replace the door’s metal strike plates. It mounts on the doorjamb and costs about $10.

- Lock your door always. Whether you’re hanging out at home, working in the yard or garage, going to work or taking an extended vacation, lock your doors. Don’t make it easy for a thief to enter your home!

Purchase adequate insurance. Homeowners and renters insurance won’t prevent lock bumping, but it can give you peace of mind. With the right insurance, you can replace any of your possessions that are lost, stolen or vandalized.

Your home’s security and peace of mind are vital. Understand and prevent lock bumping as you protect your home and family.

Read more

With the arrival of spring, you might be itching to start home improvement projects. Certain projects can reduce your home insurance costs, so consider focusing on those as you save money and improve your home.

Replace Washer Hoses

An inexpensive no-burst stainless steel hose from your local hardware store can reduce your home insurance premium by 10 percent. Attach it to your washing machine and reduce one of the most common causes of water damage.

Install a Sturdy Garage Door

Because strong seasonal winds and other stormy weather can destroy your garage door and everything in this structure, install a sturdy garage door. One that’s hurricane-resistant or fitted with horizontal and vertical braces can save you 10 percent on your insurance premium and potentially pay for itself within five years.

Hang Storm Shutters

Wind-resistant shutters could reduce your insurance costs by as much as 20 percent, and they’re particularly important if you live in a hurricane zone. Both metal and roll-down shutters protect your home.

Purchase Trouble Detectors

Smoke and carbon monoxide detectors are two investments that reduce your home insurance premiums, but consider other trouble detectors, too. They provide plumbing failure warnings, detect furnace failure or alert you to frozen water pipes. Find leak detectors and other trouble detectors online or at your local hardware store.

Invest in Fire Extinguishers

For a savings of five percent, invest in fire extinguishers. Place one in the kitchen and on every floor or your home.

Invest in Carbon Monoxide Detectors

Place one in the kitchen and on every floor or your home.

Choose Fire-Resistant Siding

Save 20 percent on your insurance premium and give your home a new exterior appearance when you install fire-resistant siding. Metal, clapboard, fiber-cement and clapboards are all Class A fire-resistant materials that are available in a variety of colors and finish styles that meet your needs.

Inspect and Repair or Replace Your Roof

Because worn shingles on your current roof won’t do much to protect your home when windy weather arrive, consider replacing your roof. Select sturdy roofing materials like metal, shake or Class 4 modified asphalt shingles. Use six instead of four staples or nails per shingle for additional savings.

These spring home improvement projects can decrease your premium. You’ll also save money when you drop additional structure coverage, increase your deductible, make automatic payments and combine home and auto policies. Discuss the details with your insurance agent as you save money and protect yourself this season and throughout the year.

Read more

Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive.

Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive.

Survival Essentials

A warm blanket, spare set of clothes and matches could make the difference in your survival. Pack these and all other essential supplies you might need in an airtight container that’s easily accessible.

Food and Water

The Red Cross suggests families store two weeks’ worth of food and water, which means you’ll need one gallon of water per person per day and a variety of easily prepared, non-perishable foods. Don’t forget to stock baby and pet food if necessary, too.

First Aid

Minor bumps and bruises can occur as your family rushes to safety. Your first aid kit should include basic first aid supplies like bandages, antibacterial cream, burn cream and pain reliever. Pack prescription medications, hearing aid batteries and other specialized medications if needed.

Hygiene Items

Toilet paper, toothbrushes and diapers are essential. Hand sanitizer and bleach should also be included in your emergency kit.

Stay Connected

You’ll want to stay connected to the outside world and signal for help, so include a battery-powered radio, extra batteries, your cell phone and chargers in your emergency kit. A flashlight and whistle for each person is also a good idea.

Tools

Whether you have to dig out of the basement or open a soup can, tools come in handy. Stock a multipurpose tool, work gloves, scissors, shovel, screwdriver set, hammer and manual can opener in your kit.

Important Papers

In the rush of an evacuation, you may forget to grab your purse or wallet. Copy important papers like your driver’s license, birth certificate, insurance policies and medical information. Store them, extra cash and your family’s emergency contact information in a waterproof bag to keep them safe.

This home emergency kit will play a big role in keeping you safe when volatile spring weather strikes. Update your insurance policies, too, as you stay protected and prepared.

Read more

February is the month of love. Millions of couples will get engaged on Valentine’s Day or get married this month, and couples spend an average of $260 on cards, flowers, jewelry and other gifts. Those gifts could include life insurance. It’s not the first gift you think of when you consider romance, but it’s a good way to express your love to the important people in your life. In fact, you could think of life insurance as love insurance. Seventy-five percent of life insurance purchasers buy a policy because of love. This February, show your love with a life insurance policy, too.

February is the month of love. Millions of couples will get engaged on Valentine’s Day or get married this month, and couples spend an average of $260 on cards, flowers, jewelry and other gifts. Those gifts could include life insurance. It’s not the first gift you think of when you consider romance, but it’s a good way to express your love to the important people in your life. In fact, you could think of life insurance as love insurance. Seventy-five percent of life insurance purchasers buy a policy because of love. This February, show your love with a life insurance policy, too.

Life Insurance for Yourself

When you buy a life insurance policy for yourself, you give your loved ones financial security and peace of mind. While life insurance benefits don’t replace you, they are a small way you can continue to provide for your loved ones after you’re gone. Your beneficiaries can use the money for miscellaneous purposes, including daily living expenses, an emergency fund for the future, debt repayment, school tuition or retirement account funding.

Life Insurance for Your Fiancé or Spouse

Maybe you won’t give your fiancé a life insurance policy along with the engagement ring, and a policy is probably not the first thing you buy together as a newly married couple. However, life insurance is an expression of your love and care. Your partner can choose the beneficiary and provide financial assistance to children or aging parents. The policy payout could also repay your partner’s outstanding debts, fund a favorite charity, cover end of life expenses or boost your retirement savings.

Life Insurance for Your Children

Kids have their whole lives in front of them, but they aren’t immune to birth defects, accidents and diseases like cancer. You can’t protect your kids from everything, but you can give them life insurance. A child’s life insurance policy can pay for medical expenses, funeral expenses and other end of life arrangements. It can also be donated in your child memory to his or her favorite charity or be used for the educational costs of surviving siblings. Whole life insurance policies also grow with your child. When they turn 21, they take over the policy and keep the same coverage or purchase additional insurance for their future.

This February, purchase life Insurance for your loved ones. A policy can cost less per day than your daily coffee, and it provides peace of mind. It’s a loving gift that keeps on giving. Discuss available policies with your insurance agent today.

Read more

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

Higher summer temps mean fun in the sun on weekends, but those scorching temperatures can be deadly for people who aren’t prepared for them. Heat exhaustion affects a wide variety of folks, and unfortunately, most aren’t prepared to handle it. Once the temps start to rise, one must be proactive to protect oneself from succumbing to heat exhaustion and know how to respond.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

In legal terms, an act of God isn’t, in fact, a religious experience. Well, that’s not to say that an act of God couldn’t be a religious experience, it’s just that that’s not inherent in the legal definition of the term. An act of God essentially comes down to the unforeseen and the unpreventable. You can reduce the likelihood of accidents on the job site by making sure that you don’t allow any drinking, fighting or general carelessness on site, you can reduce the likelihood of accidents on the road through proper auto maintenance, but you can’t prevent a flood or an earthquake no matter how many safety courses you attend.

With the arrival of spring, you might be itching to start home improvement projects. Certain projects can reduce your home insurance costs, so consider focusing on those as you save money and improve your home.

With the arrival of spring, you might be itching to start home improvement projects. Certain projects can reduce your home insurance costs, so consider focusing on those as you save money and improve your home. Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive.

Heavy rains, floods, hurricanes can all threaten your home and family this spring. While no amount of preparation prevents volatile spring weather, a home emergency kit helps you prepare to be safe and survive. February is the month of love. Millions of couples will get engaged on Valentine’s Day or get married this month, and couples spend an average of $260 on cards, flowers, jewelry and other gifts. Those gifts could include life insurance. It’s not the first gift you think of when you consider romance, but it’s a good way to express your love to the important people in your life. In fact, you could think of life insurance as love insurance. Seventy-five percent of life insurance purchasers buy a policy because of love. This February, show your love with a life insurance policy, too.

February is the month of love. Millions of couples will get engaged on Valentine’s Day or get married this month, and couples spend an average of $260 on cards, flowers, jewelry and other gifts. Those gifts could include life insurance. It’s not the first gift you think of when you consider romance, but it’s a good way to express your love to the important people in your life. In fact, you could think of life insurance as love insurance. Seventy-five percent of life insurance purchasers buy a policy because of love. This February, show your love with a life insurance policy, too.